Tags:Invoicing, create, e-document, 4.0

Lesson ID-103.29

Updated to:

26/11/2025

Lesson objective

That the user knows how to generate an e-document 4.0 version, quickly and easily, knowing in general the minimum requirements.

Create an e-document version 4.0

The issuance or generation of an e-document or invoice is a process by which the taxpayer prepares a digital tax file that contains the specific characteristics defined by the Tax Administration Service (SAT) and that, when certified by an Authorized Provider of Certification of digital tax receipts (PAC), becomes a legally valid document.

To generate a Digital Tax Receipt via the Internet e-document 4.0, you must access the system as indicated in lesson ID-101.1

Enter the "Invoicing"module.

Click the "Create invoice" button located in the "Actions" menu.

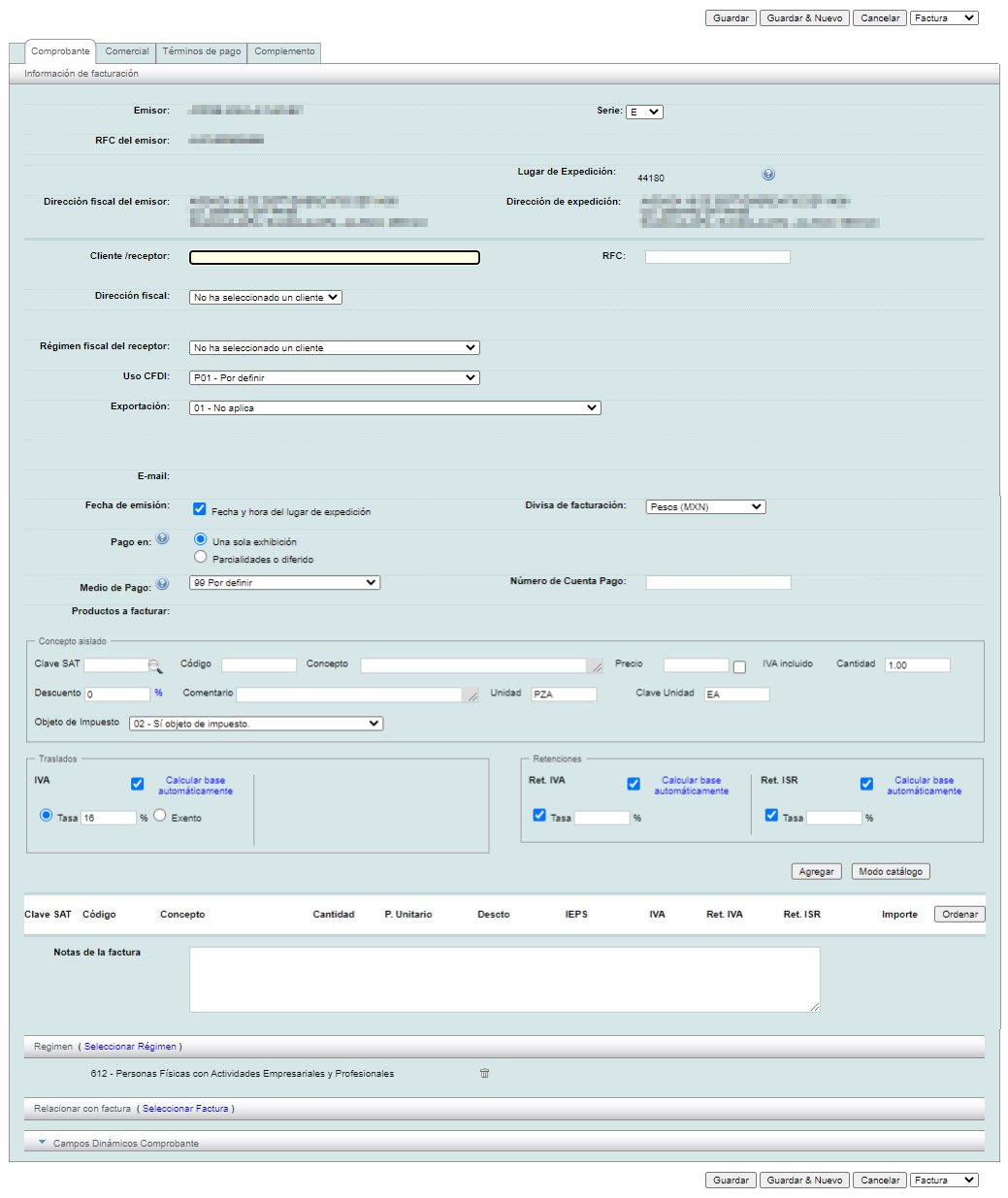

The form where you must enter the e-document information will be displayed. Next, we will take a general look at each of its sections.

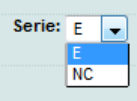

E-document series

Select the "Serie" you wish to use according to te tax effecto for your e-document. If you have any questions about this, please refer to lesson ID-103.1

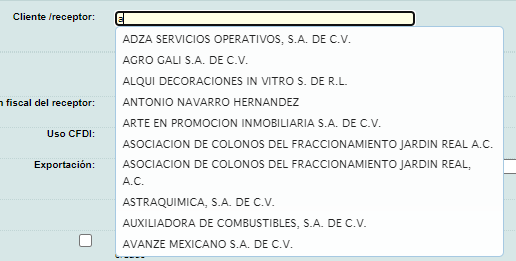

"Receiving" Customer

Enter the name or RFC of the "Cliente Receptor" of the e-document; as you enter the data, a list with the pre-loaded information from the database will be displayed.

If you have not yet registered the customer, refer to lesson ID-104.1

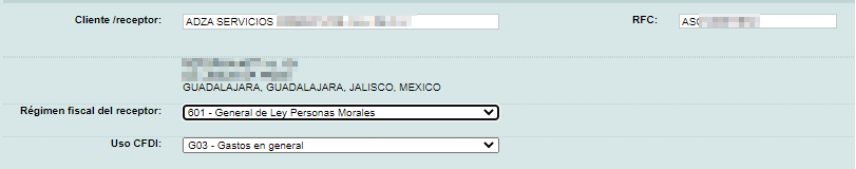

When you select "Customer", the system will complete the information.

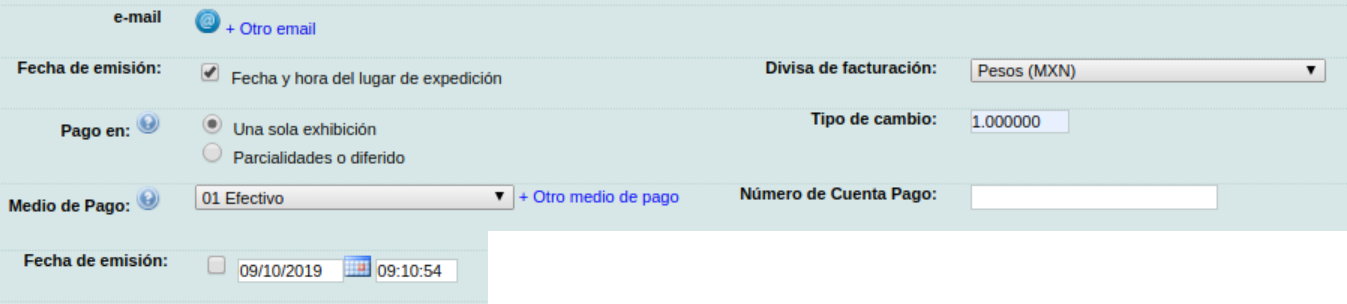

Invoicing information

- Uso CFDI: (Mnadatory) Use of this CFDI with the SAT, the options are those specified in the catalog c_UsoCFDI del SAT.

- Exportación: (Mandatory) The code used to identify whether the document covers an export transaction must be registered; the current codes are included in the catalog. By default, “01 - No aplica” is displayed.

- E-mail: Once this receipt has been created, you can send it by email to the email address you specify.

- Fecha de emisión: (Mandatory) The Fecha y hora del lugar de expedición of issuance are selected by default. If the Lugar de Expedición field is not filled in, the invoice Serie (branch location) will be used as the reference. If you need to create an e-document with a different date, uncheck the box; the fields for adding the desired date and time will then appear. If the date is earlier than the current date, it cannot be less than 72 hours later. If you need a date later than the current date, it cannot be more than 1 hour and 5 minutes later.

- Pago en:(Mandatory) In version 4.0, it represents "método de pago". If the payment is in installments (PPD) and Medio de Pago should be "99 Por definir".

- Medio de Pago: (Mandatory) In version 4.0 represents "forma de pago". The options are those specified in the SAT´s c_FormaPago catalog.

- Divisa de facturación: (Mandatory) If the currency is other than MXN (mexican pesos) the Tipo de cambio must be specified.

- Tipo de cambio: Tipo de cambio against pesos mexicanos when the currency is other than MXN.

- Número de Cuenta Pago: account to which the payment for this e-document will be made.

Products

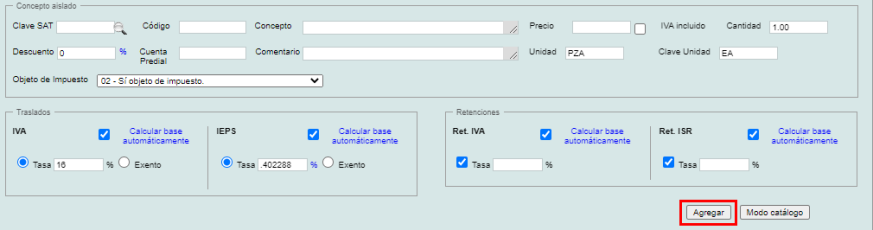

Next, you must enter the products/services you wish to invoice.

If you are in "Modo catálogo" as you fill in the "Código" or "Nombre" field, the products/services stored in the system will be displayed.

If you are in "Modo manual" you can quickly search for product/service keys by clicking te magnifying glass. For more information, go to lesson

ID-105.3.

See lesson ID-103.15 to find out what mode the system is in.

As a minimum requirement, you need to specify the producto/servicio, precio, cantidad, unidad, clave de unidad y objeto de impuesto para poder agregarlo.

Note. If the concept is for real estate rental activity, the Cuenta Predial field must be indicated. If it is not displayed, please contact Technical Support.

Once all the information has been added, click on the "Agregar" button.

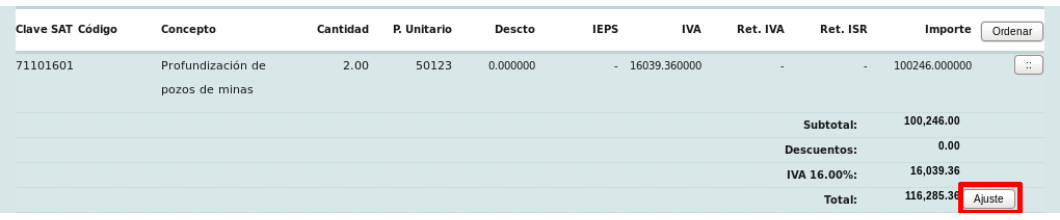

By pressing the "Agregar" button, the information will be displayed at the bottom of the screen. If you wish to add more products, follow the process described above.

The summary of added products and invoice totals will be displayed below.You will find an "Ajuste" button next to the invoice total. This allows you to manually edit the invoice amounts, however, this is not permitted by the SAT (Mexican Tax Administration Service). Therefore, if you attempt to create the invoice after editing the amounts calculated by the system, the e-document will not be generated.

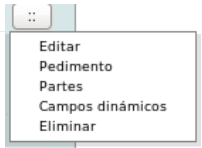

If you wish to edit, delete, or add any extra information to the product/service in this list, click on the icon.

If you wish to edit, delete, or add any extra information to the product/service in this list, click on the icon.

Invoices notes

The "Notas de factura" field is optional and is reflected in the printed (PDF) representation of your e-document. This section has no character limit, so you can enter any special information you wish to send to your customers.

Save the e-document

Once finished, press the "Guardar" button located at the bottom of the screen. It is important to ensure that the information entered is correct, as the e-document cannot be edited once it has been generated.

![]()

Please confirm that the information is correct by clicking "Aceptar" button.

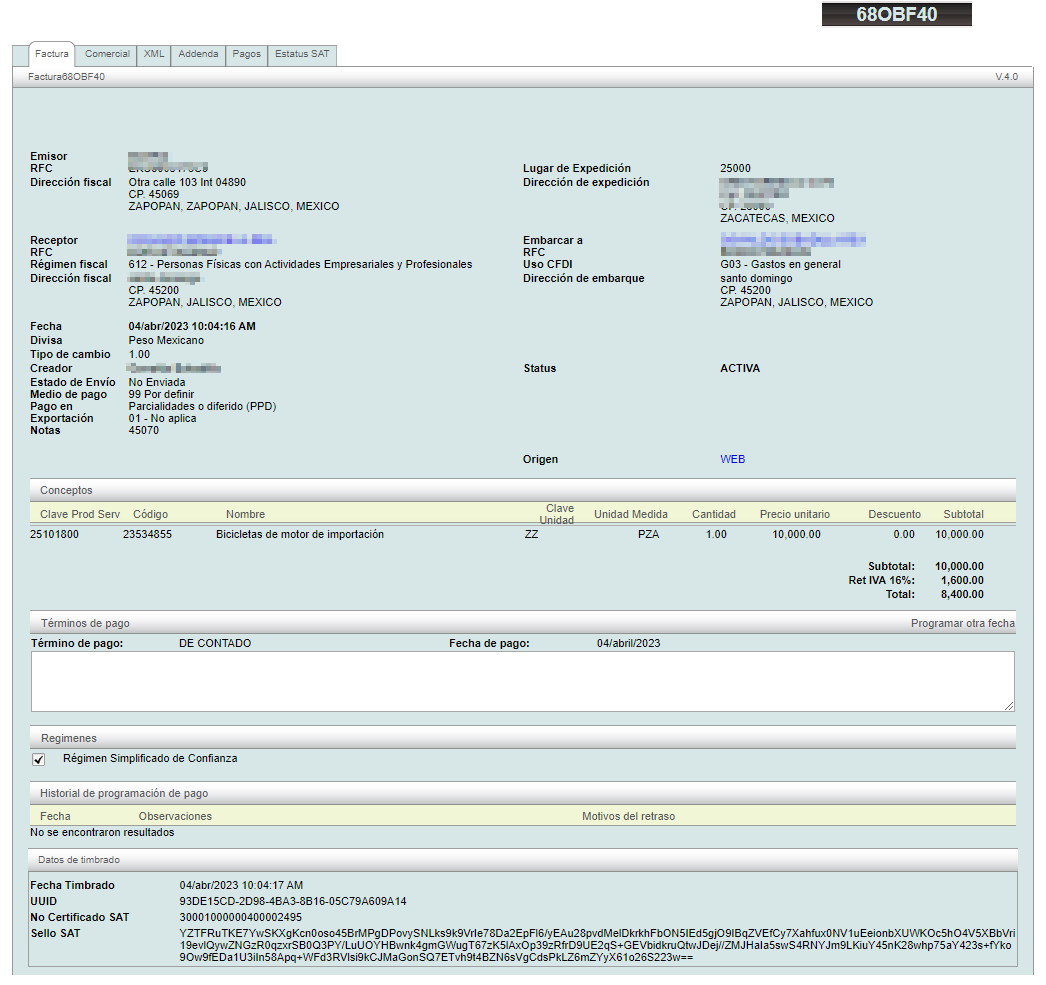

Main e-document screen

Once saved, you can view the information and perform various actions with generated e-document.

This summary includes information about the e-document´s creation (Fecha / Creador / Envío / Forma de pago) and the status (Activa / Cancelada).

To download your e-document and/or send it to your client, refer to lesson ID-103.4