Tags: Invoicing, e-document 4.0, public revenue, general

Lesson ID-103.27

Updated to:

25/04/2023

Lesson objective

That the user knows how to create a general public income for version 4.0 of e-document.

Create a general public income

To perform this action, you must first log into the system as indicated in lesson ID-101.1

Step 1

Go to the "Invoicing" module.

![]()

Step 2

Once inside the module, look for the "Actions" column on the left and select the "Crear comprobante" option. Upon logging into the system, the "Invoicing" tab will display the form for creating the e-document.

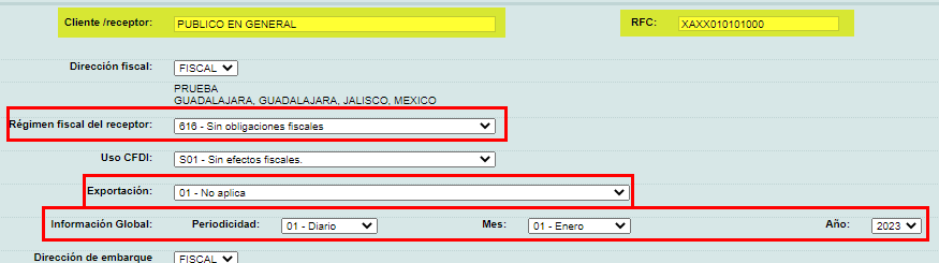

The new visible fields are:

- Régimen fiscal receptor

- Exportación*

- Información global**

* This attribute defaults to “01-No aplica” and should not be changed.

** This attribute is only required when the client name is “PUBLICO EN GENERAL” and the RFC is “XAXX010101000”.

The period, month covered by the document, and year of general sales must be indicated.

Step 3

Next, the recipient's information is captured and the remaining information from the e-document is entered.

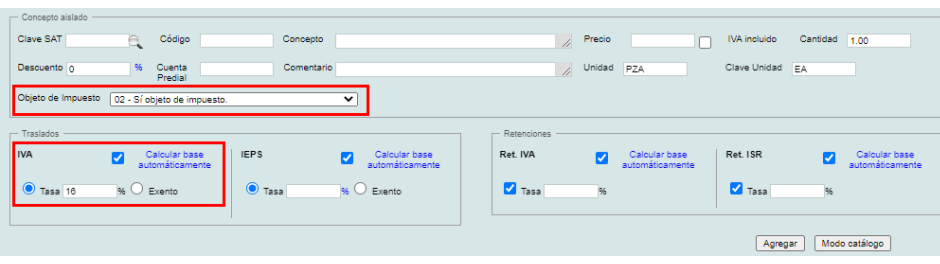

If an isolated concept is captured, it displays the new attribute "Objeto de impuesto", which has a default value of "02-Si objeto de impuesto" that taxes the transferred IVA tax, otherwise, it must be changed manually.

Finally, press "Agregar" at the bottom right of the window.

Note: If you have any questions, please contact our Technical Support department. To migrate to version 4.0, click Here.