Tags: Invoicing, Update, migration

That's it! You can now start using the latest version of the CFDI 4.0 and e-documents.

Lesson ID-103.25

Update to: 04/02/2026

Lesson objective

Allows users to migrate their Digital Tax Receipt (CFDI) to version 4.0 quickly and easily.

CFDI update to version 4.0.

The Tax Administration Service (SAT) published in the Official Gazette of the Federation the Second Resolution of Modifications to the Miscellaneous Tax Resolution for 2022 and its Annexes 1-A, 23, 30, 31 and 32, which came into force on March 10, 2022, and with them, the mandatory implementation of invoicing 4.0 as of July 1, 2022.

Lesson objective

Let the user know the steps to follow to change to version 4.0 of the e-document.CFDI version update

To implement the new version 4.0 of the Solución Factible® invoicing system, it will be necessary to perform the migration in the most user-friendly and rapid way.

Step 1

- Enter the login link as shown in the lesson ID-101.2

- Once inside the system, enter the “Invoicing” module.

Step 2

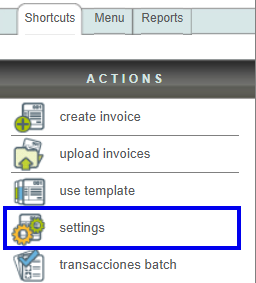

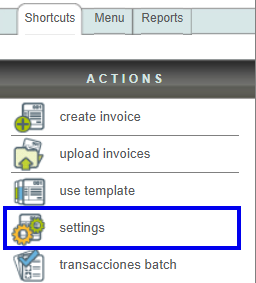

- Then, click the “Settings” button in the “Actions” menu.

Step 3

- The available options in the configuration panel will then be displayed. Click on the “Cambio de versión de CFDI” option.

Step 4

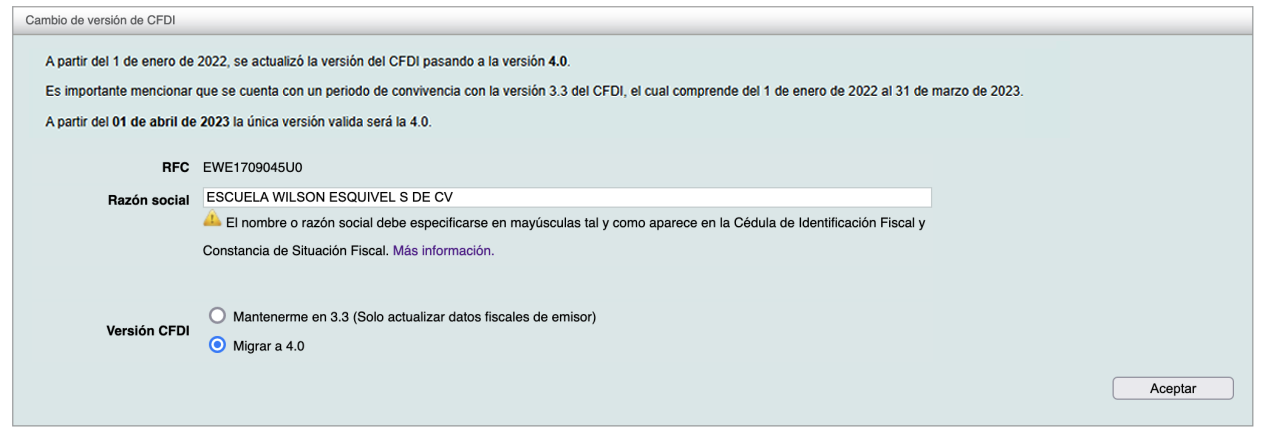

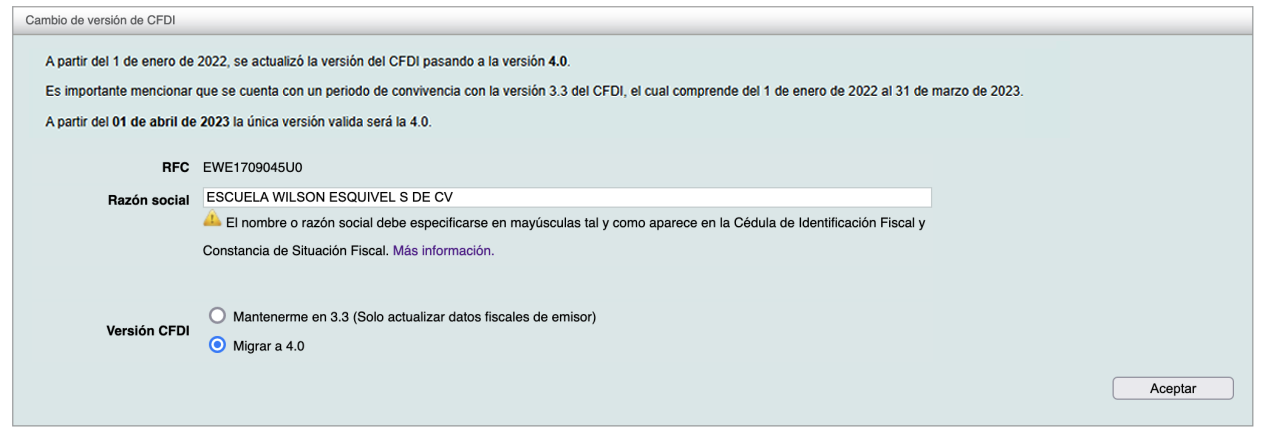

- The system will then display the tool to migrate to the new version 4.0.

Step 5

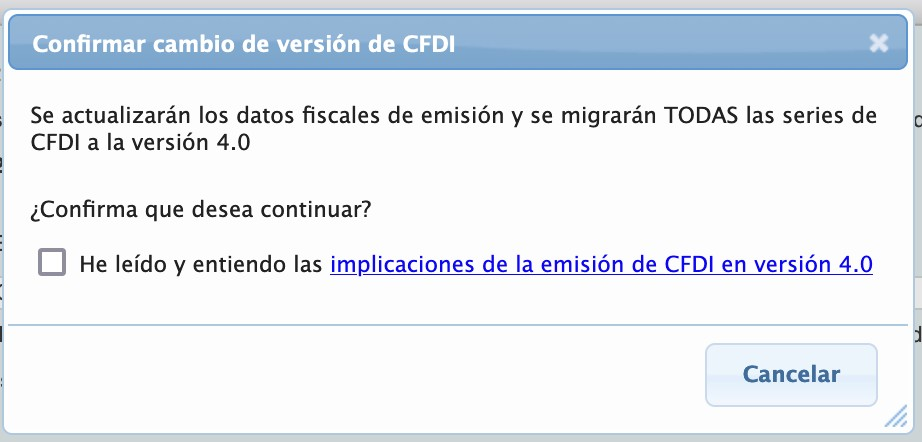

- Choose “Migrar a 4.0”, and a dialog box will appear:

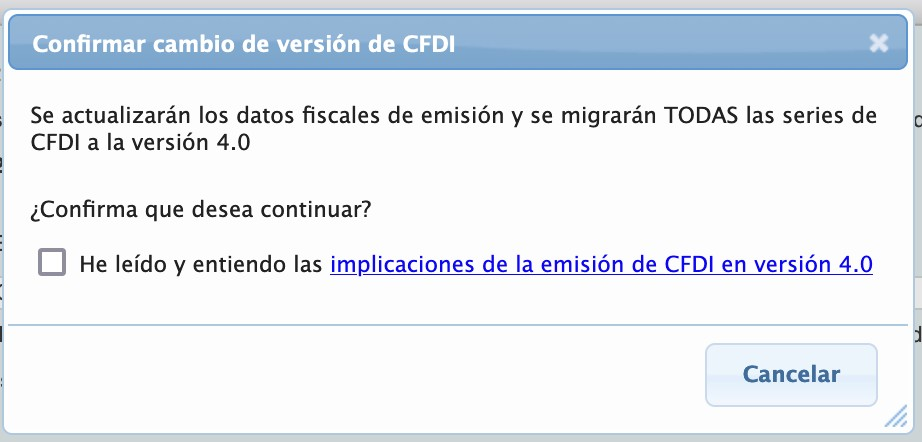

- Select the box “He leído y entiendo las implicaciones de la emisión de CFDI en versión 4.0”.

Step 6

- And finally, a confirmation box will appear.

Note: If you have any questions, please contact our Technical Support departament.