Tags: Invoicing, Update 4.0, regime

With this simple tax regime update you will be able to use version 4.0 of the e-document and its add-ons in their latest version.

Lesson ID-103.26

Updated to: 25/11/2025

Lesson objective

That the user knows the steps to follow to update the tax regime of the e-document version 4.0.

Receiver regime update for version 4.0.

It is necessary to confirm that the recipient's tax information is up to date before issuing any tax e-document in version 4.0. To do this, you can access the customer's settings by following the steps described in lesson ID-104.2.

Update to the recipient's regime

To issue any e-document version 4.0, it is necessary to update the recipient's tax regime in the Solución Factible® invoicing system.

Step 1

- Enter the login link as shown in lesson ID-101.2

- Once inside the system, enter the “Customers” module.

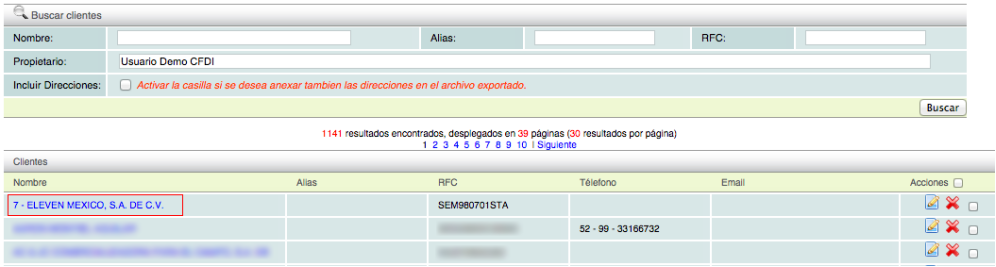

Step 2

- Once inside the Module, you will be able to view the customer catalog. Then, click on the customer whose data you wish to edit.

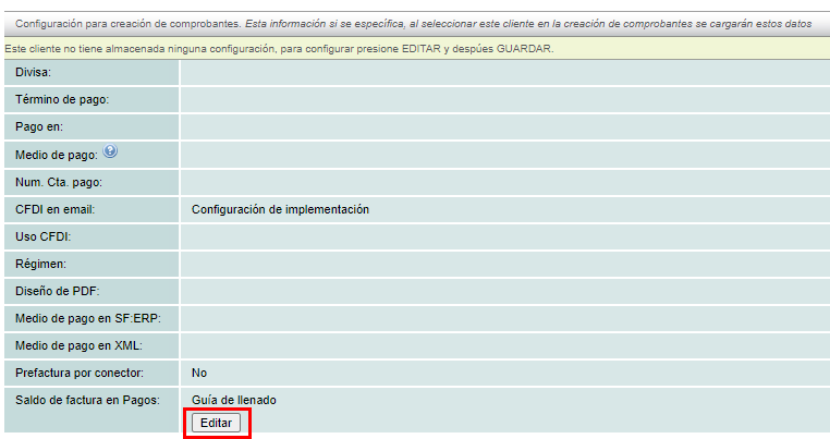

Step 3

- The selected customer's information summary will then be displayed. Go to the "Invoicing" tab.

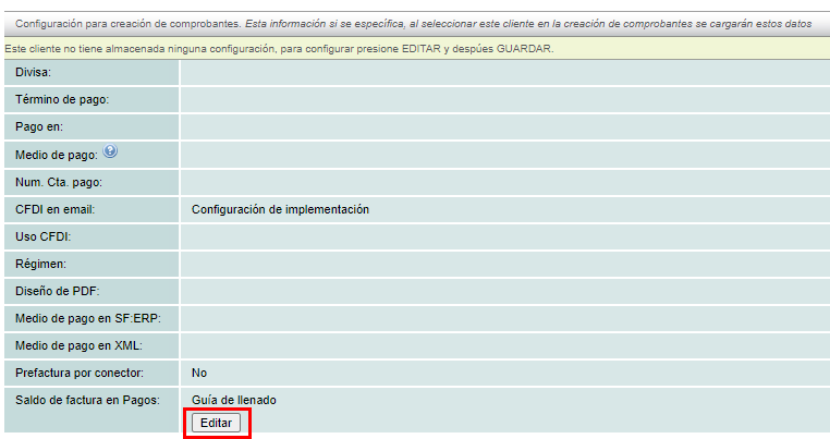

Step 4

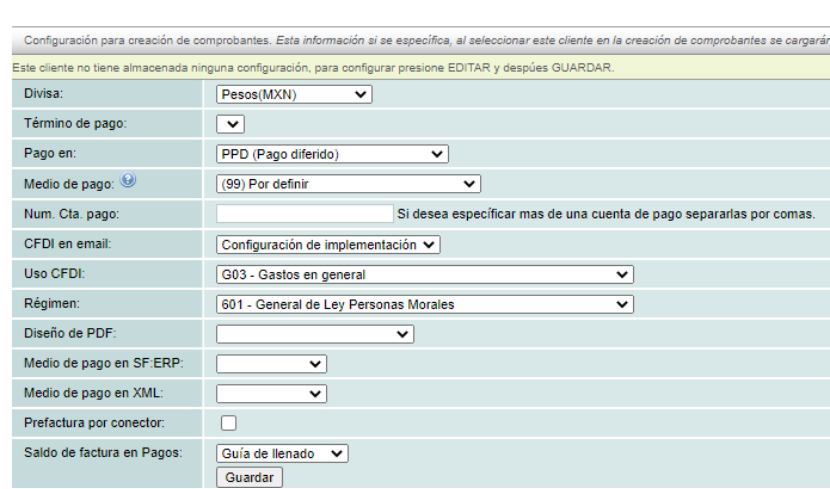

- Next, the e-documents you have generated will be displayed. At the bottom of the screen, you will find the sections to edit the invoicing information. Click the "Edit" button to activate the fields.

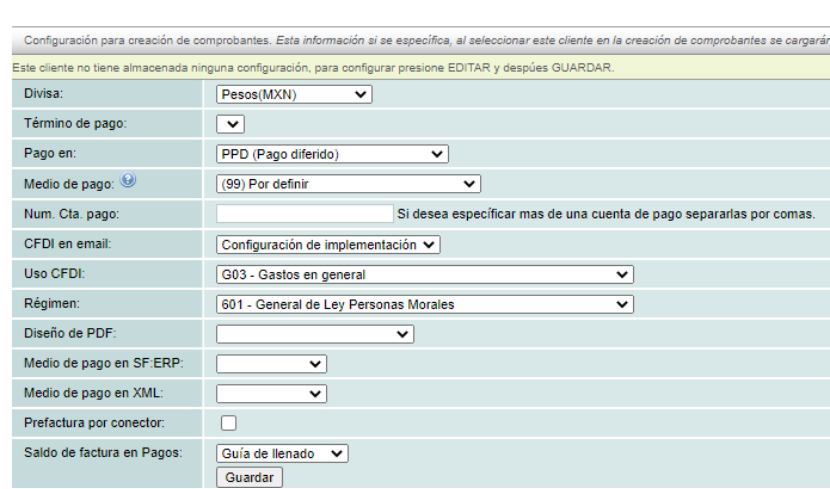

Step 5

- It is necessary to indicate the Uso de CFDI, so that the system can show us the list of Régimenes.

Step 6

- After specifying the necessary fields, click the "Guardar" button to update the tax information.

Note: If you have any questions, please contact our Technical Support Department.