Introduction

Reception and validation of e-documents

If you receive a large number of invoices, we offer the ability to automate the e-documents reception and validation process, saving your company time, money, and effort.

Legislation requires the recipient of the e-documents to validate it in order to be able to deduct it. Ensure that the e-documents you receive are created in compliance with the law and avoid any type of tax fraud.

At Solución Factible®, we developed a customized dashboard to make it easier for you to manage your e-document reception process.

The dashboard, am.ong other features, allows you to view e-documents received via various means, such as email, web, AS2, EDI, etc., as well as maintain direct communication with your suppliers.

Lesson Objective

At Solución Factible®, our commitment is to provide you with the necessary tools to make your job easier. This tutorial will help you upload the generated CFDs and CFDIs to your clients.

Upon completion, you will be able to upload e-documents. Rest assured, the tax validation of your e-documents is performed by a company certified as an Authorized Certification Provider (PAC) by the SAT (Tax Administration Service), whose experience guarantees that approved invoices meet all the tax requirements specified by the authority.

Before you begin

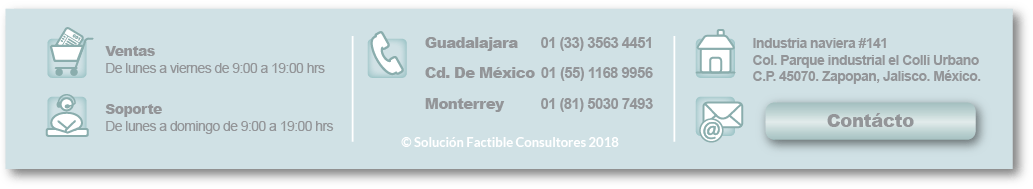

In addition to this tutorial, your client will provide you with a username and password to log in to the system. If you don't have one yet, please contact your client to obtain this information.