La LCO fue actualizada por última vez el 02/mar./2026

EFOS and EDOS validation options

First step:

Enter the ERP and log in with your corresponding username.

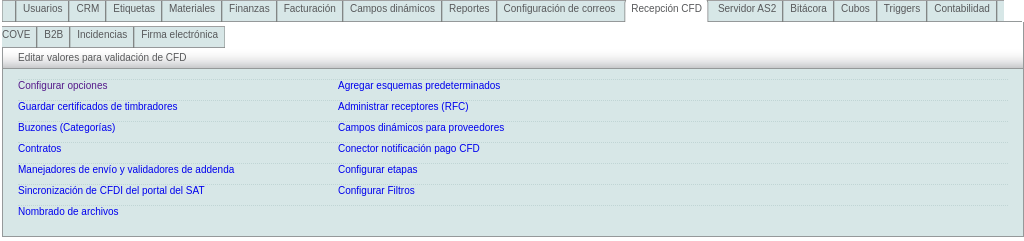

After logging in, click on the configuration section.

Second step:

Go to the CFD Reception section.

Once the tab is displayed, click "Configure Options."

Third step:

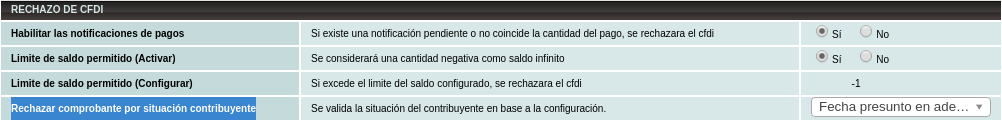

Once the "CFDI REJECTION" option is displayed,

Scroll down to the "Reject receipt due to taxpayer status" section.

Choose one of the different statuses available, taking into account its meaning (either Presumptive, Disputed, Final, or Favorable Ruling).

Possible statuses:

Presumed

- Presumed date onward.

- Always reject.

Distorted

- Presumed date - Distorted date.

- Always reject.

Definitive

- Presumptive date onward.

- Definitive date onward.

- Always reject.

Favorable Ruling

- Presumptive Date - Favorable Date.

- Final date - Favorable date.

- Always reject.

Definitions of important dates to apply:

- Presumptive Date = This is the moment the SAT suspects suspicious activities.

- Disproved Date = This is the moment the SAT withdraws its suspicions of suspicious activities.

- Definitive Date = This is the moment the SAT makes a statement regarding suspicious activities.

- Favorable Date = This is the moment the SAT releases information about a lawsuit and confirms that it is not illegal.

Links de referencia:

- Listado de contribuyentes con presuntas operaciones simuladas | english

- Webservice ConsultaRFC | english

- Decreto de la Reforma 69-B / Reform Decree 69-B)

- Diagrama 69-B (PRODECON) / Diagram 69-B (PRODECON)

- Repercusiones Legales (Cárcel por 6 años) / Legal Repercussions (6 years in prison)

- Referencia lista de EFOS / Reference list of EFOS