Tags: Invoicing, create, e-document, retention

Lesson ID-103.10.2

Updated to:

29/10/2025

Lesson objective

The user must generate an electronic document for withholdings and payment information.

Create a withholding e-document and payment information

It is important not to confuse this e-document with a normal invoice to which a withholding tax is added to a product.

ID-103.10 - Create an e-document with withholding

This e-document allows you to document tax withholdings and payments made to residents abroad.

From the SAT website:

"When you are required to issue a CFDI (Financial Declaration of Income) for tax withholdings or payments made during an economic activity, generate a withholding invoice or payment information. For example, in the case of the sale of shares, dividends or distributed profits, royalties for copyrights, payments made to foreign residents, or deductible real interest on mortgage loans."

To perform this action you must first log in to the system as indicated in lesson ID-101.1

De click en la pestaña "Withholdings" del menú principal

De click en el botón "create retention"

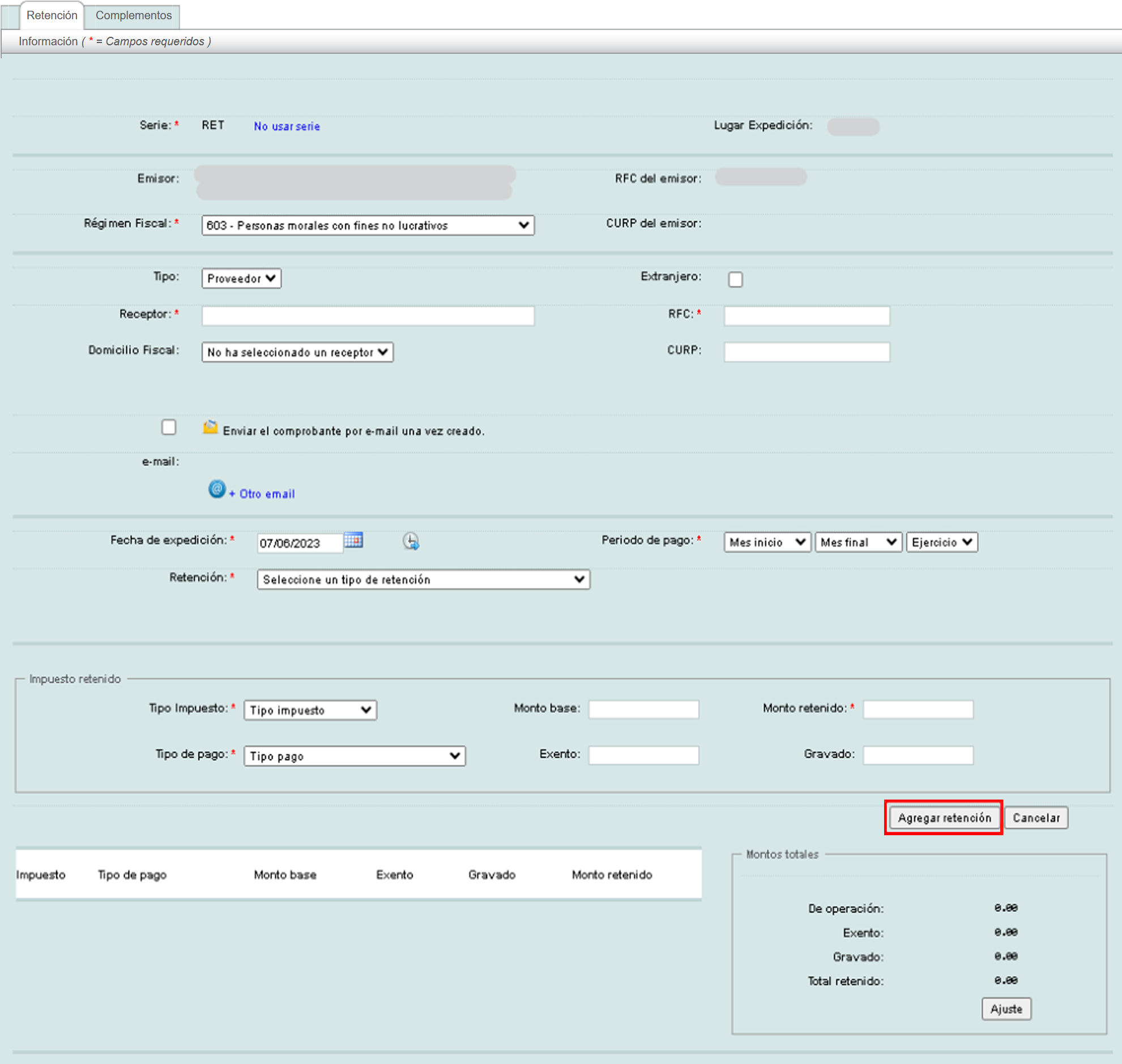

The new withholding tax CFD window will be displayed. Remember that fields marked with an asterisk "*" are mandatory.

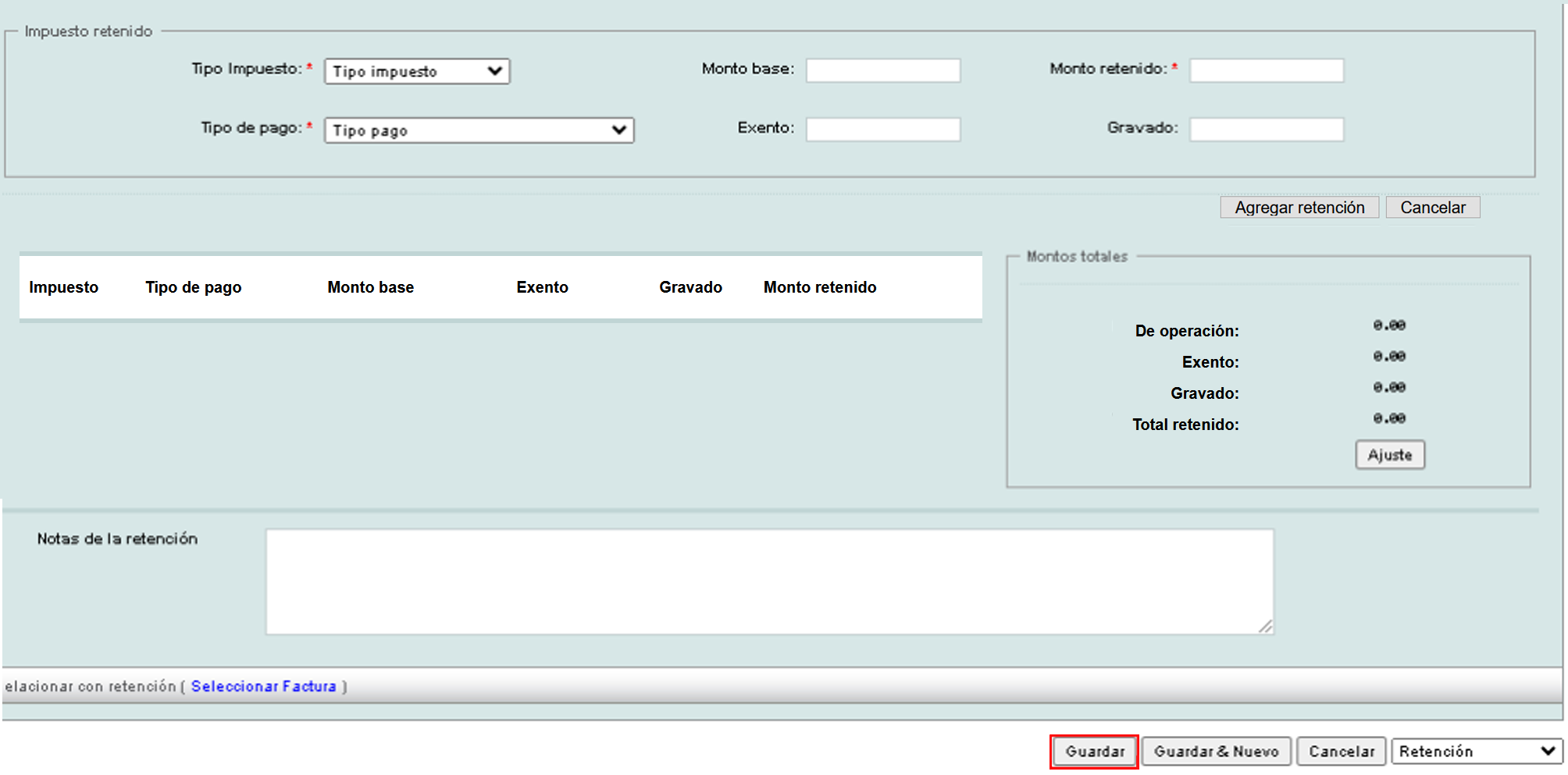

In the "Impuesto retenido" section you can add the necessary withholding; once the data is filled in, click on the "Agregar retención" button.

Once the amount has been added, it will be displayed in the "Montos totales" box. You can add as many amounts as needed. When finished, click the "Guardar" button to create the invoice.