2.3 CFDI 4.0 Cancellation

Introduction

Starting January 1, 2022, all cancellation requests must contain the reason for canceling the CFDI. In the event that the cancellation reason is "01 - Voucher issued with errors in relation" the UUID of the voucher that replaces the voucher to be canceled must be specified.

In order not to change the SOAP data contract and avoid compatibility problems with the services implemented by our clients, in the Solución Factible cancellation services it will be possible to include a cancellation string instead of the UUID, which includes the UUID to be cancelled, reason for cancellation and the related UUD that replaces the receipt to be cancelled.

For more details consult the catalog of Allowed reasons for cancellation.

Reasons for cancellation:

-

Code Description 01 Voucher issued with errors regarding. 02 Receipt issued with unrelated errors. 03 The operation was not carried out. 04 Nominative transaction related to a global invoice. When code 01 is selected, an additional field must be enabled to record the fiscal folio that replaces the receipt.

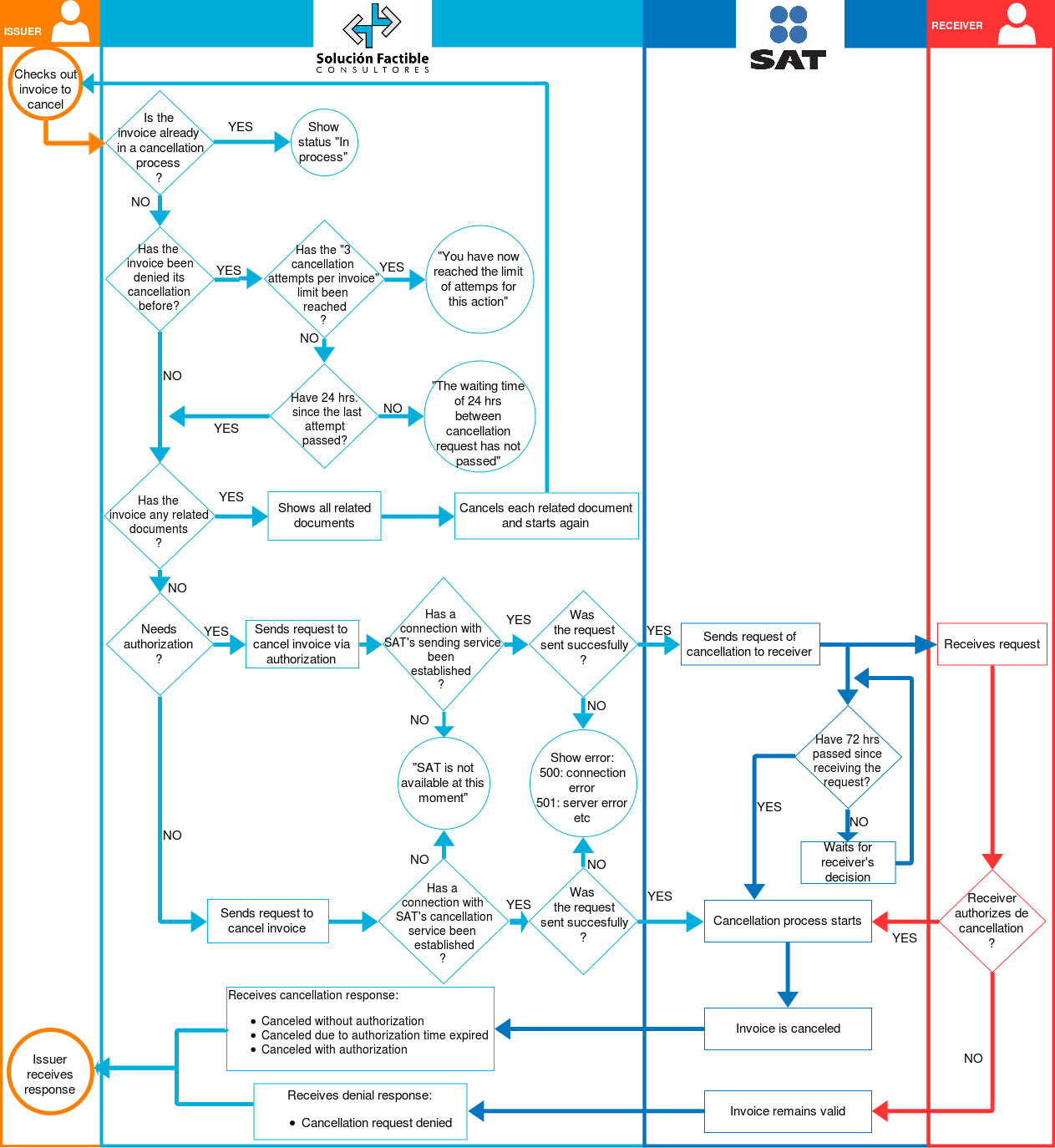

Cancellation process

In the new scheme there are cancellation states with which the SAT will inform what state the CFDI 4.0 is in. It is worth mentioning that these statuses are different from the CFDI statuses which are only "Current" and "Cancelled".

Considerations for CFDI cancellation in 2022:

1. Specify cancellation reason

The reason why the cancellation of a CFDI is requested must be specified.

- Voucher issued with errors regarding

This cancellation reason applies when the generated invoice contains an error in the product key, unit value, discount or any other data, so it must be reissued. In this case, first a new invoice is issued, relating it to the invoice with errors using the relationship type “04 – Sustitución de CFDI previos” and when the cancellation is requested, the reason for cancellation is specified “01 - Comprobante emitido con errores con relación” and the folio of the invoice that replaces the canceled one is specified.

- Receipt issued with unrelated errors

The reason for cancellation must be specified 02 - Comprobante emitido con errores sin relación when the generated invoice contains an error in the recipient's RFC, the product key, unit value, discount or any other data and is not required to be related to another generated invoice. However, if an invoice is issued to replace the canceled voucher, it is necessary to specify relationship type 04 when creating the new voucher.

- The operation was not carried out

This reason for cancellation will be used in cases where an invoice has been issued for a sale or the provision of a service that was not carried out.

-

Nominative transaction related to a global invoice

This cancellation reason applies to cancellation of global invoices in cases where a customer requests an invoice for a transaction that was already included in a global invoice. In this case the procedure to follow is the following:

- The cancellation of the global invoice must first be requested, specifying the reason for cancellation by specifying the reason for cancellation 04 - Operación nominativa relacionada en una factura global.

- Subsequently, the global receipt must be reissued without considering the amount of the transaction for which an invoice has been requested.

- Finally, the invoice requested by the client can be issued.

You can find more details in the cancellation FAQs published on the SAT portal in the Related Content section of the page “Electronic Invoice Update – Tax Reform 2022”.

2.- Was the CFDI cancellation request rejected by the recipient before?

If the cancellation request was rejected by the recipient the first time, and the issuer attempts to cancel the voucher again, subsequent cancellation requests enter a “negativa ficta” process, which means that as long as the recipient does not accept the cancellation request cancellation within a period of 72 hours, the cancellation of the CFDI will not proceed. The issuer can continue to request the cancellation of the CFDI, however, explicit acceptance from the recipient will be required for it to be processed successfully.

3.- Do not have current related documents

The following requirement is: If the receipt you wish to cancel has at least one related document in force, it cannot be cancelled. The voucher will have a cancellation status of "No Cancelable" before the SAT.

It is necessary to break the relationship of each document related to the receipt. This is achieved simply by canceling the related document or specifying the reason for cancellation 01 – Comprobante

emitido con errores con relación and the folio of the related receipt that it replaces is included in the same cancellation request, this is applicable only for relationship type 04 – Sustitución de CFDI previos. When the receipt does not have related documents, it is necessary to verify if the recipient's authorization is necessary before requesting cancellation with the SAT.

When the receipt does not have related documents, it is necessary to verify if the recipient's authorization is necessary before requesting cancellation with the SAT.

4.- Do you need authorization?

There are certain cases for which the recipient's authorization is NOT necessary, such cases are:

- CFDI that cover income for a total amount of up to $1,000.00 (one thousand pesos 00/100 M.N.) including taxes and withholdings.

- CFDI issued for payroll, such as a payroll or fee receipt, only in the year in which they are issued.

- The CFDI issued for expenses, such as the credit note.

- CFDI issued for transportation, such as a carta porte.

- The CFDI issued for income issued to taxpayers of the Fiscal Incorporation Regime (RIF).

- Those that cover CFDI withholdings.

- CFDI issued in operations with the general public with RFC: XAXX010101000 (in accordance with rule 2.7.1.21 of the Miscellaneous Tax Resolution for 2022).

- CFDI issued to residents abroad with RFC: XEXX010101000 (in accordance with rule 2.7.1.23 of the Miscellaneous Tax Resolution for 2022).

- When the cancellation request is made within the day following its issuance.

- The CFDI issued for income, which are issued by natural person taxpayers in the primary sector, that is, those natural persons considered in accordance with rules 2.7.3. and 2.7.4.1. (from the Miscellaneous Tax Resolution for 2022).

- The CFDIs issued by the members of the financial system.

- The CFDI issued by the Federation for rights, products and uses.

In these cases, the CFDI will have a cancellation status of "Cancelable sin aceptación" before the SAT and its cancellation may be requested without further requirements. Once the request is sent, the cancellation status will be "En proceso".

If the CFDI does NOT fall into these cases, it will have a status of "Cancelable con aceptación", which means that the recipient's authorization is necessary.

5.- Recipient Authorization

If authorization from the recipient is required, Solución Factible will send the request for cancellation authorization to the SAT, and the SAT will send it to the recipient in their tax mailbox. Said request will have the RFC and name of the issuer, along with the fiscal folio of the receipt. Once the authorization cancellation request is submitted, the cancellation status will be "En proceso".

Once the request is received in the tax mailbox, the recipient will have 72 hours to accept or reject the request. If after 72 hours, the recipient has not rejected or accepted the cancellation, the SAT will automatically cancel the invoice, and the issuer of the invoice will be informed through Solución Factible.

6.- Response to cancellation

Once the cancellation process is completed, the issuer will receive the response to their request that will include the new status of the CFDI along with the cancellation status.

- When the CFDI was canceled without requiring the recipient's authorization, the recipient will have a status of "Cancelado" and a cancellation status of "Cancelado sin aceptación."

- When the CFDI has been canceled with the recipient's authorization, the recipient will have a status of "Cancelado" and a cancellation status of "Cancelado con aceptación."

- When the CFDI was canceled because authorization was requested from the recipient, he did not respond and after 72 hours the voucher was considered cancelled; This will have a status of "Cancelado" and a cancellation status of "Cancelado plazo vencido".

- When the CFDI has NOT been canceled due to the recipient rejecting the request, it will have a status of "Vigente" and a cancellation status of "Solicitud rechazada".

Deadlines for cancellation of CFDI

On January 25, 2022, the Tax Administration Service (SAT) released the first draft of the first modification to the Miscellaneous Tax Resolution 2022, which highlights the modification to rule 2.7.1.47, in its publication In the RMF, said rule contemplated January 31 of the year following its issuance as the deadline to cancel a CFDI, the draft extends that deadline and now contemplates that it will be no later than the month in which it is due. present the annual ISR declaration corresponding to the fiscal year, in which the aforementioned receipt was issued.

Deadlines for cancellation of CFDI

2.7.1.47. For the purposes of article 29-A, fourth paragraph of the CFF, the cancellation of the CFDI may be carried out no later than the month in which the annual ISR declaration corresponding to the fiscal year in which the aforementioned declaration was issued voucher.

…

CFF 29-A

It should be noted that this period does not apply to global CFDIs issued by individuals who pay taxes under the Régimen Simplificado de Confianza.

Cancellations with Credit Note

In accordance with the Federal Tax Code, the issuance of CFDI expenditure must have justification and documentary support that proves the refund, discounts or bonuses, therefore, for the purposes of canceling CFDI, the procedure specified by the SAT must be followed. , indicating the reason for canceling the document.

In the case of the refunds, discounts or bonuses referred to in article 25 of the Income Tax Law, digital tax receipts must be issued online. In the event that receipts are issued that cover expenses without having the justification and documentary support that proves the refunds, discounts or bonuses before the tax authorities, these cannot be reduced from the tax receipts of the taxpayer's income, which can be verified. by them in the exercise of the powers established in this Code.

https://www.diputados.gob.mx/LeyesBiblio/pdf/CFF.pdf p55

Process diagram