Arithmetic rules of an invoice

Introduction

Since January 1, 2018, it is mandatory that, when creating an invoice, certain arithmetic rules stipulated by the SAT (Mexican Tax Administration Service) be followed:

Total sum

The sum of all amounts must equal the total of the invoice without exception. If any difference is found, even by one decimal place, the invoice is invalid.

Number of decimal places per currency

The SAT publishes in its catalogs the number of decimal places allowed per currency, for example in the case of the Mexican peso (MXN) there are 2 decimal places for the cents.

Number of decimal places for calculations

When calculating the different amounts on an invoice, you can use a larger number of decimal places to achieve greater accuracy; however, the final amounts must be rounded to the number of decimal places of the currency used.

Calculation order

The order for calculating the amounts on an invoice is:

- Amount = price * unit

- Taxes (Transfers and Withholdings) = (base * rate)/100

- Subtotal = (sum of amounts)

- The Subtotal and Taxes are rounded to the number of decimal places of the currency

- Total = Subtotal - (sum of discounts) + (sum of transfer taxes) - (sum of withholding taxes)

Examples

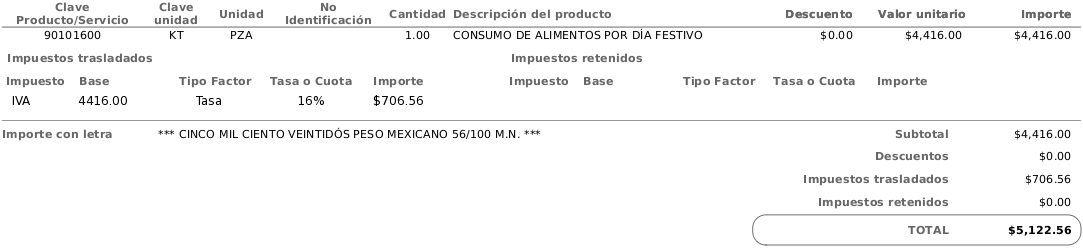

Invoice with IVA

We wish to invoice a restaurant service to which IVA will be applied:

| Concept | Price | Unit | IVA Rate |

|---|---|---|---|

| FOOD CONSUMPTION PER HOLIDAY | 4,416.00 | 1.00 | 16% |

amounts taxes discounts

- Amount = 4,416.00 * 1.00 = 4,416.00

- Taxes (IVA on Transfers) = (4416 * 16)/100 = 706.56

- Subtotal = 4,416.00

- The subtotal and taxes are rounded to the number of decimal places of the currency (MXN).

- Total = 4,416.00 + 706.56 = 5,122.56

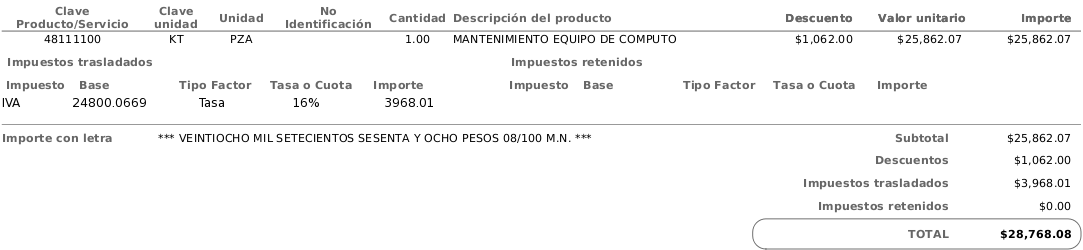

Invoice with discounts

We wish to invoice a computer maintenance service with a discount:

| Concept | Price | Unit | IVA Rate | Discount |

|---|---|---|---|---|

| COMPUTER EQUIPMENT MAINTENANCE | 25,862.0669 | 1.00 | 16% | 1,062.00 |

- Amount = 25862.0669 * 1.00 = 25,862.0669

- Taxes (IVA on Transfers)) = (24800.0669 * 16)/100 = 39,68.010704. Base = amount - discount

- Subtotal = 25,862.0669

-

The Subtotal and Taxes are rounded to the number of decimal places of the currency (MXN)

25,862.0669 -> 25,862.07; 3,968.010704 -> 3,968.01 - Total = 25,862.07 - 1,062.00 + 3,968.01 = 28,768.08

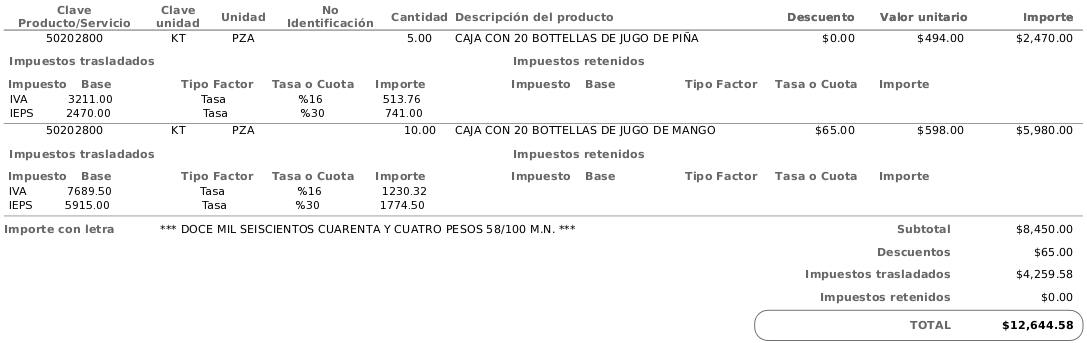

Invoice with multiple taxes (transfers and withholdings)

We wish to invoice a sale of products with discounts and transfer taxes:

| Concept | Price | Unit | IVA Rate | Discount | IEPS Rate |

|---|---|---|---|---|---|

| BOX WITH 20 BOTTLES OF PINEAPPLE JUICE | 494.00 | 5.00 | 16% | 0.0 | 30% |

| BOX WITH 20 BOTTLES OF MANGO JUICE | 598.00 | 10.00 | 16% | 65.00 | 30% |

- Amount 1° concept: 494.00 * 5.00 = 2,470.00

-

Taxes 1° concept:

a) IEPS: (2470.00 * 30)/100 = 741.00

b) IVA: (3211.00 * 16)/100 = 513.76. Base = amount - discount + IEPS - Amount 2° concept: 598.00 * 10.00 = 5,980.00

-

Taxes 2° concept:

a) IEPS: (5915.00 * 30)/100 = 1,774.50. Base = amount - descuento

b) IVA: (7689.50 * 16)/100 = 1,230.32. Base = amount - descuento + IEPS - Subtotal = 2470.00 + 5980.00 = 8,450.00

- The subtotal and taxes are rounded to the number of decimal places of the currency (MXN).

- Total = 8,450.00 - 65.00 + 4,259.58 = 12,644.58