Tags: Invoicing, complement, retention, local taxes

Lesson ID-103.11.2

Updated to:

13/10/2025

Lesson objective

That the user knows how to add the local tax complement to an e document in the Solución Factible® invoicing system.

Local tax complement

Complement to include data identifying a local tax, such as taxes on lodging or accommodation services, professional services, leases, among others.

To perform this action you must first log in to the system as indicated in lesson ID-101.1

The creation of the e-document in general does not change, so you must generate it according to your needs. If you have questions about the general creation of an electronic document, refer to lesson ID-103.2

To add it, click on the "Complemento" tab at the top of the form.

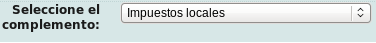

Next, click and select the "Impuestos locales" complement from the list.

Clicking on this will display a form where you must specify the complement data. The fields to be used are explained below.

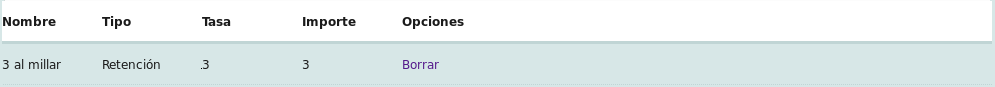

- Tipo: Expresses the type of tax (Retención o Traslado).

- Nombre: State the name to identify this tax.

- Tasa: Expresses the percentage rate given by the government for this tax.

- Importe: Expresses the amount of tax given by the rate applied to the product or service provided.

Because these taxes are set by state governments, although the concept is the same, rates can vary from state to state. Therefore, you should always be aware of the rate set by your state government.

N per thousand

There is a type of tax that causes confusion due to its calculation and that is the "N" type per thousand (3 per thousand, 5 per thousand, etc.). If you are invoicing a concept for a total of $ 1,000, to determine the "3 per thousand" tax you must determine the amount given by the given rate, in this case .3%, then: (1,000 * .003) = $ 3. It is important to know that the system will not do the calculation so you must do it.

Once all the data has been entered, click the "Agregar" button.

The registered tax will be displayed. If you wish to delete it, click the Borrar option. If you wish to add another tax, enter the details and click the "Agregar" button again.

When you finish entering the complement information, save the receipt. If you have any questions about this, refer to lesson ID-103.2