Tags: ComplementCFDI, carta porte 3.1

Lesson ID-103.11.5

Updated to

23/10/2025

Lesson objective

That the user knows how to create a CFDI with the Carta Porte 3.1 complement.

Carta Porte 3.1 Complement

We recommend using the SAT´s guide to fill the lading complement to avoid inconveniences.

Note: This lesson shows how to create a 3.1 complement with a transfer within the national territory and motor transport as the transport type.

To perform this action you must first log in to the system as indicated in lesson ID-101.1

First, you must start filling out a CFDI of type Income (I) or Transfer (T), and before saving the CFDI, you must add the complement. Remember that to select the CFDI type, you must choose the series configured in your account for Income or Transfer receipts.

If you have questions about the general creation of an electronic document, please refer to the lesson

ID-103.2

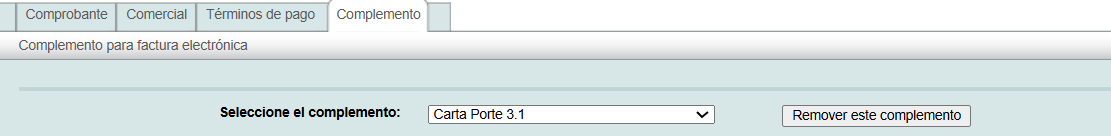

To add it, select the e-document and click the "Complemento" tab at the top of the form.

Choose the option "Carta Porte 3.1".

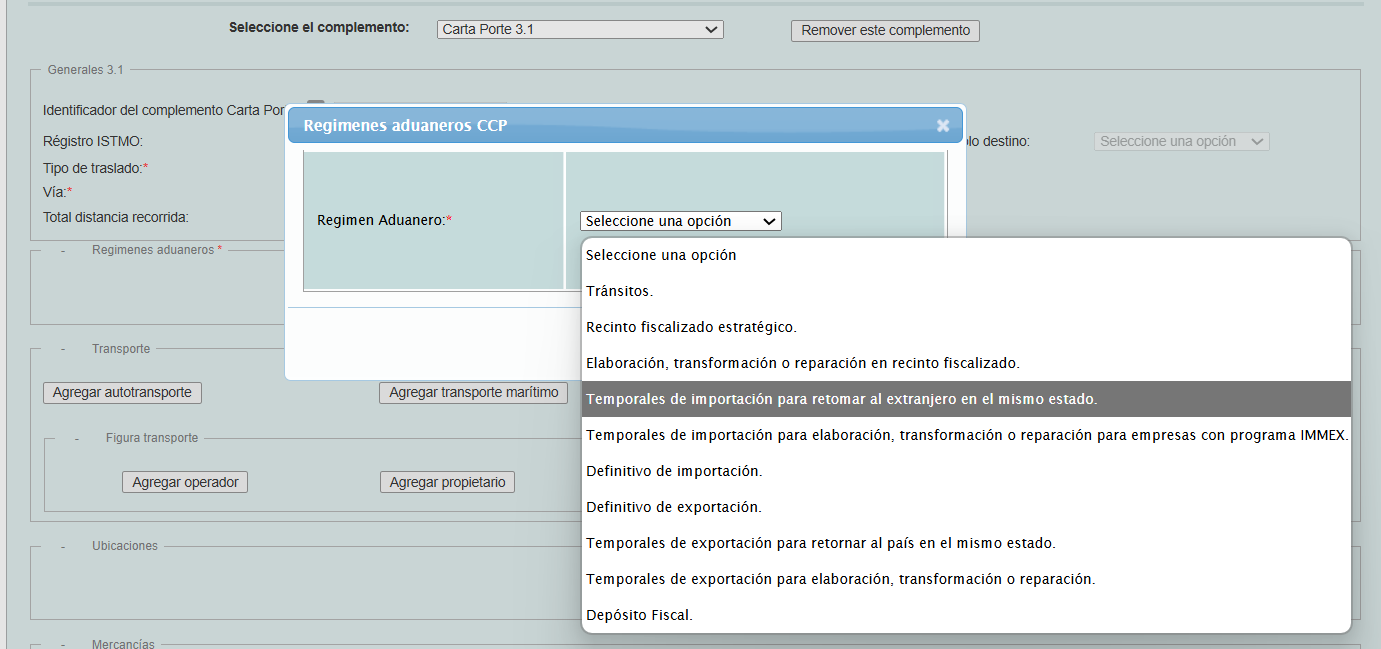

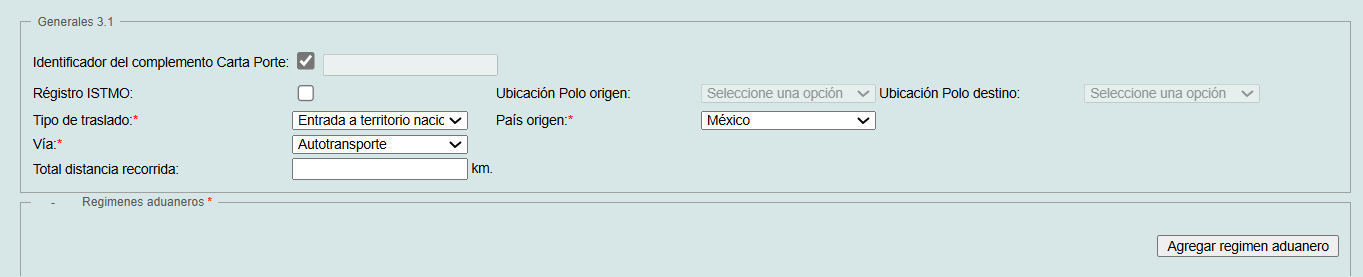

In the first section, "Generales 3.1," fill in the required fields: "Tipo de traslado*", "Vía*"and "País de origen*", then, click the "Agregar regimen aduanero" button, select the "Régimen aduanero*" type, and click "Agregar Regimen".

The "Total distancia recorrida" field can be omitted as it is automatically calculated based on the information entered in the Ubicaciones section.

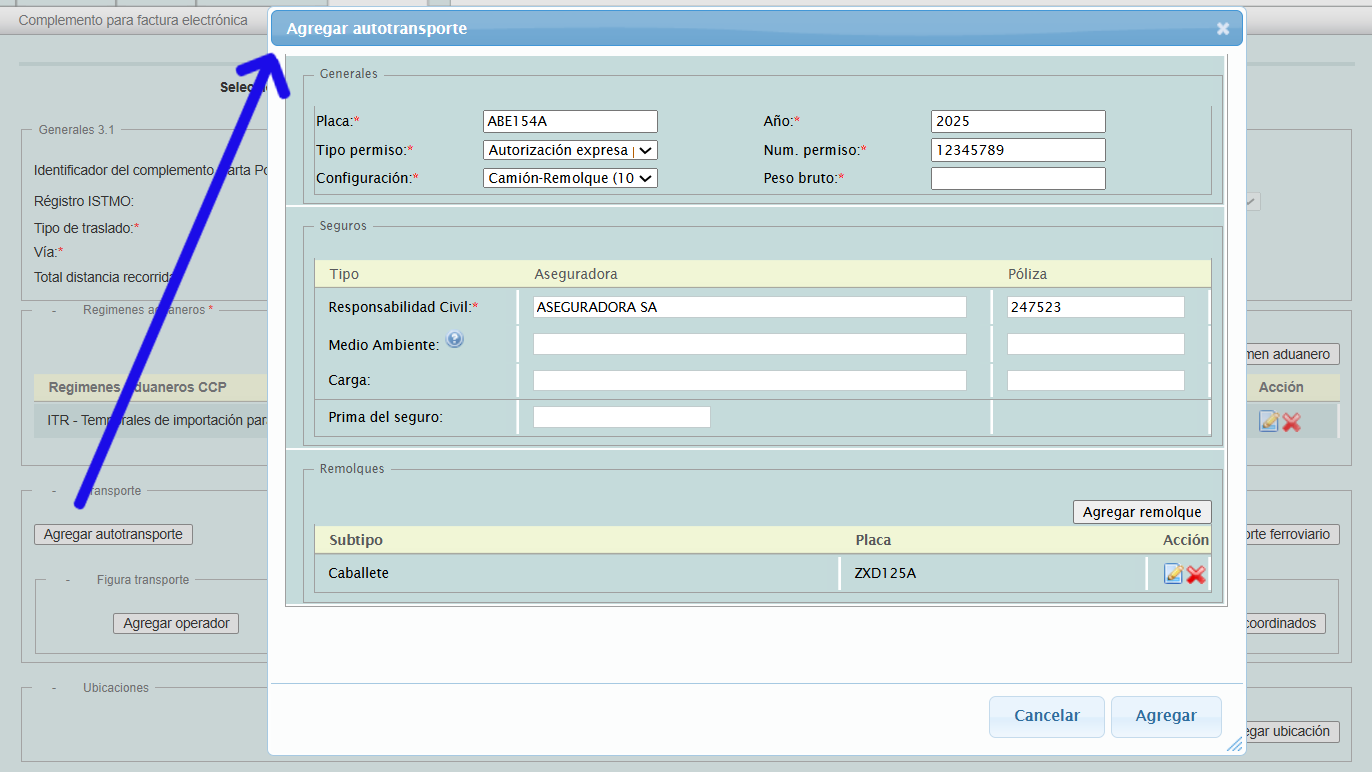

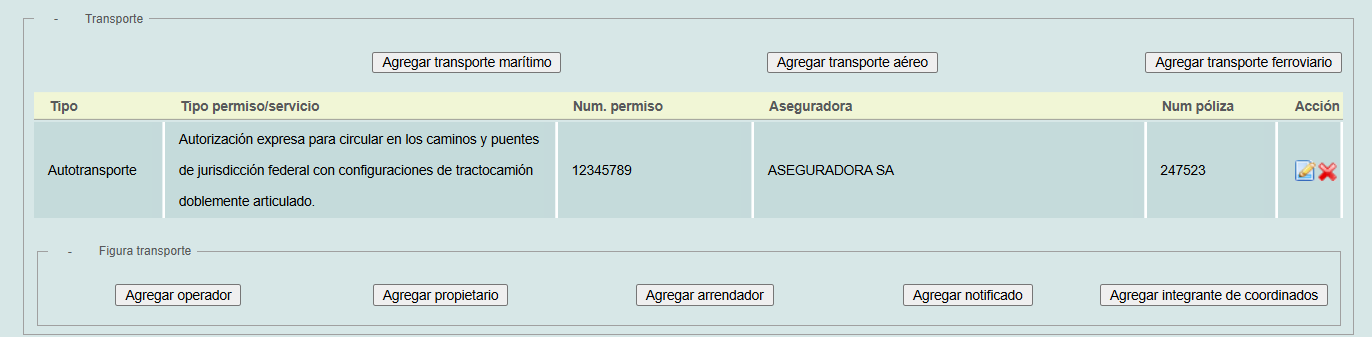

In the "Transporte" section, add the type of transportation. A drop-down menu will appear. All fields must be filled out.

Then press the "Agregar" button.

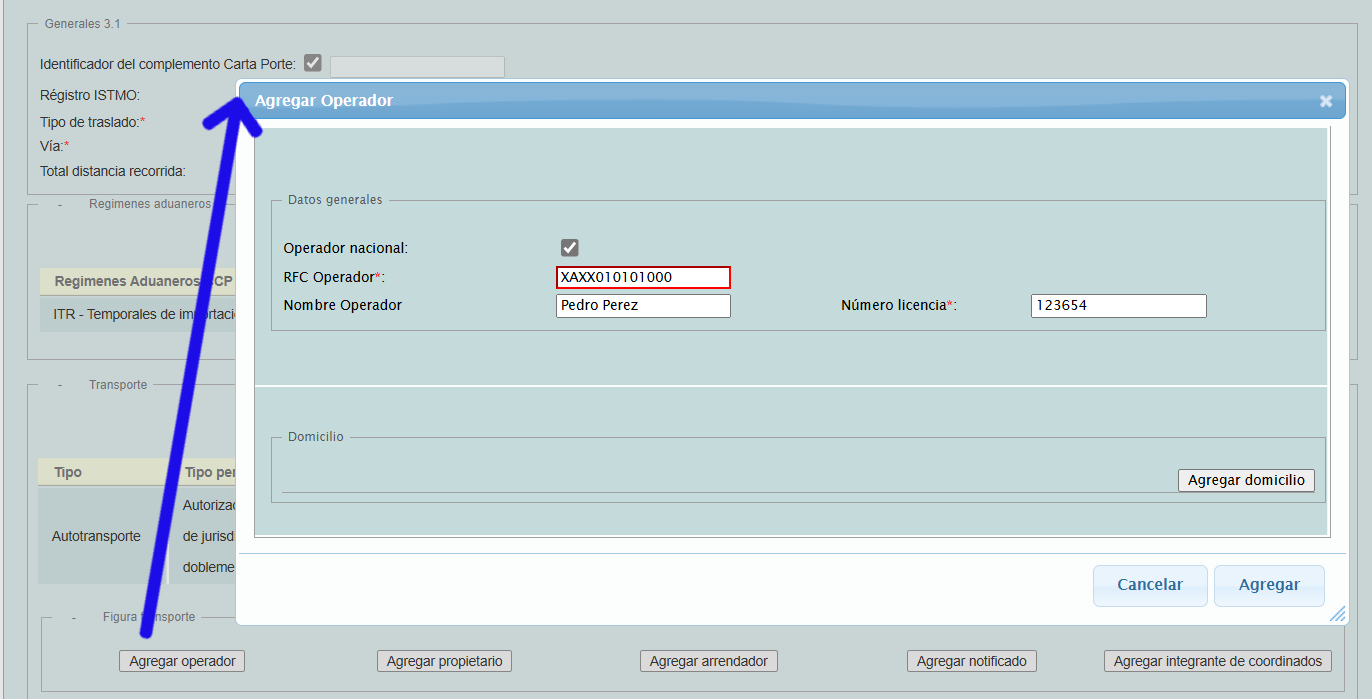

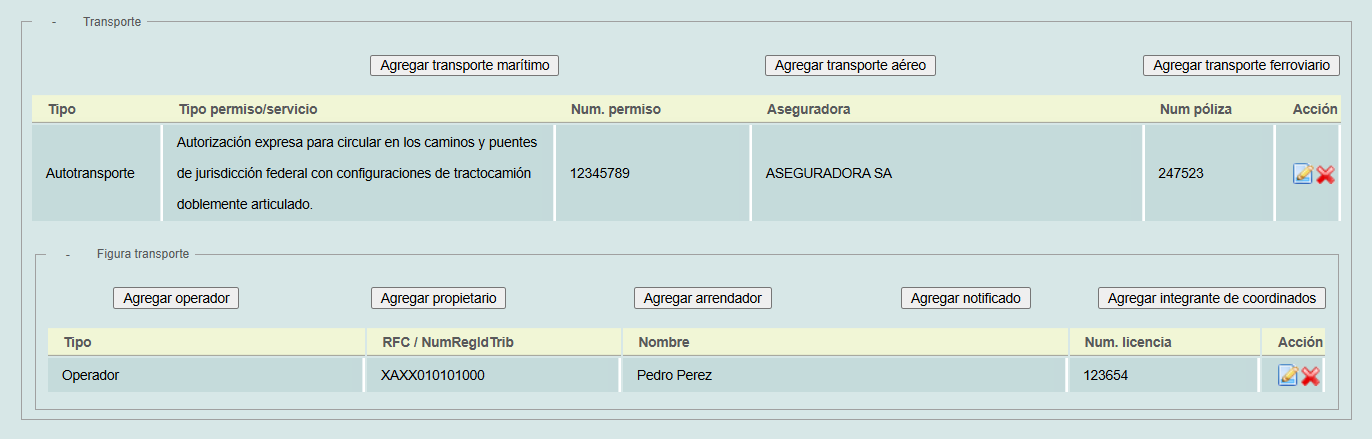

In the "Figura transporte" sub-section, it is only mandatory to add an operator when the transport is "Autotransporte".

Note: An owner is only required when the issuer of the e-document is not the owner of the vehicle, trailer, or any part being used to transport the goods.

Press the "Agregar" button.

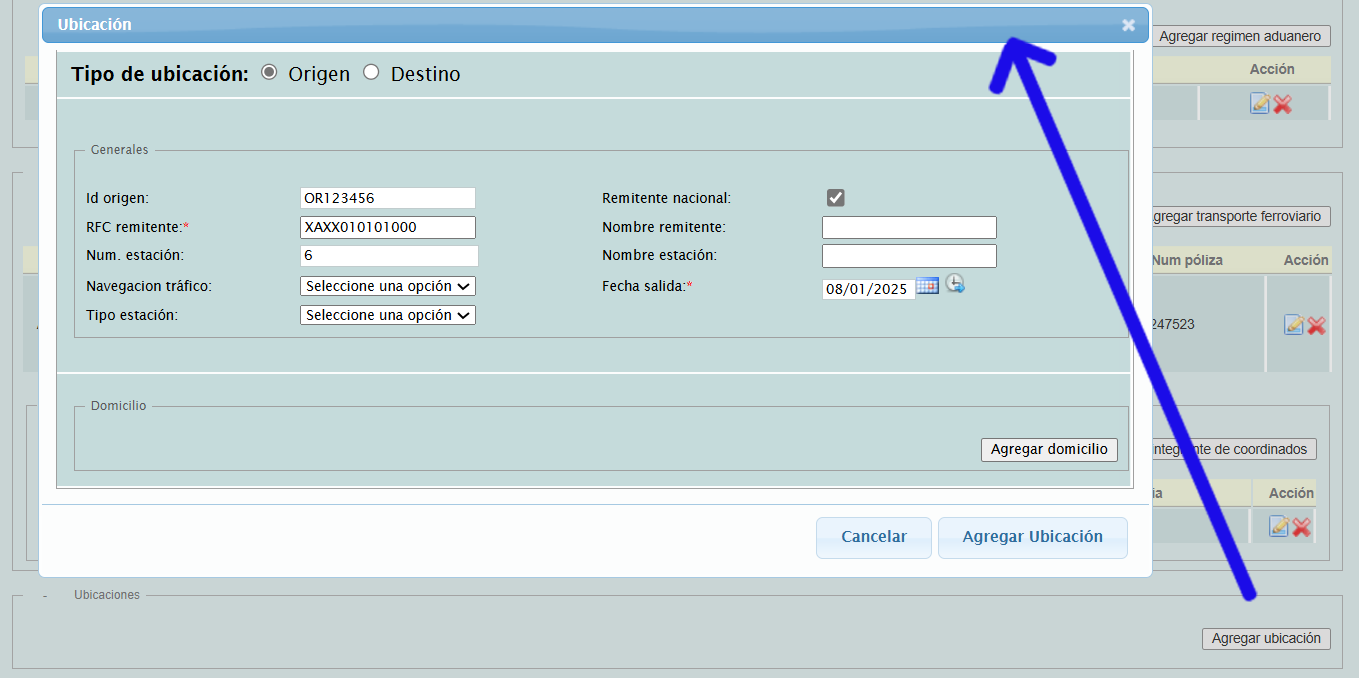

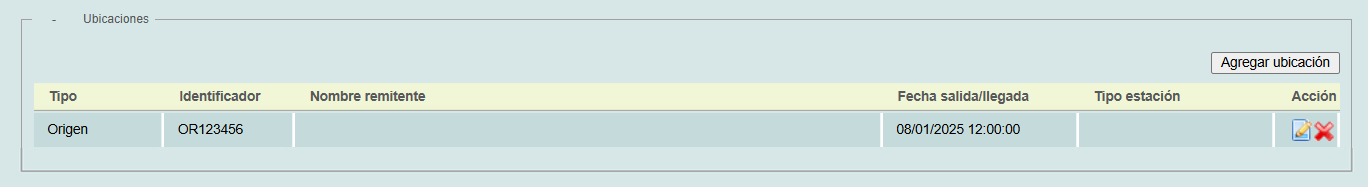

In the "Ubicaciones" section below, you'll need to add a source and destination location. Click the "Agregar ubicación" button.

Only the RFC remitente and Fecha salida fields are mandatory; the Id origen (origin location) and Id destino (destination location) fields are mandatory only when there is more than one destination location.

Note: These two fields are in the OR/DE + 6-digit format, e.g.: OR125478 / DE98532

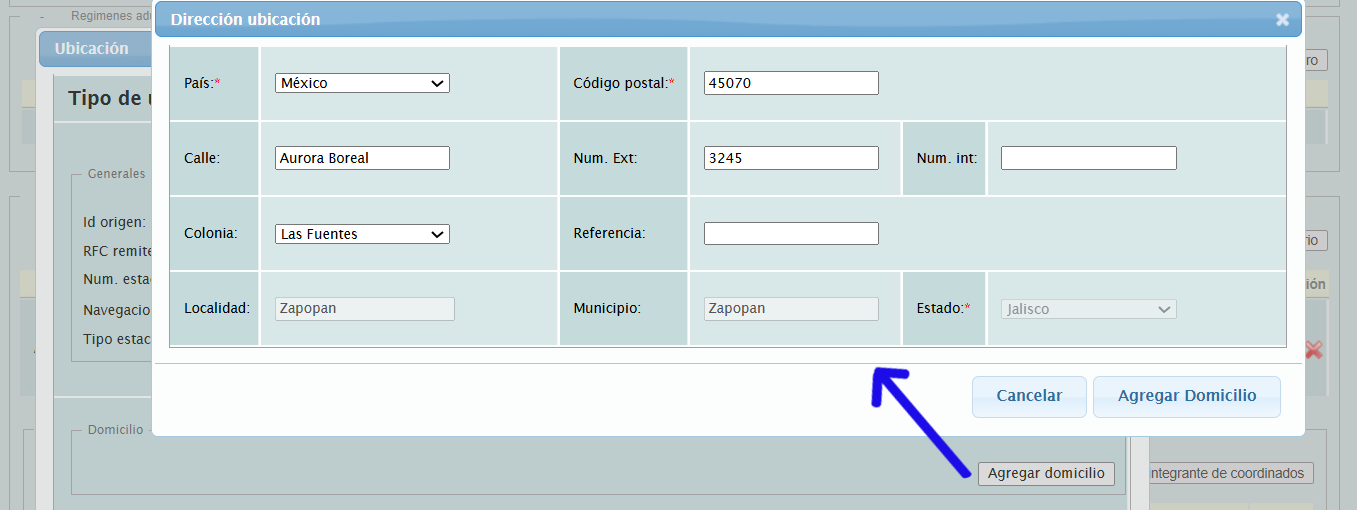

It is mandatory to add an address; the required fields are: : País, Calle, Colonia and Código postal. When you enter the postal code, the SF platform will automatically provide you with the Localidad, Municipio, and Estado information for the address.

Then, press the "Agregar Domicilio" button and then the "Agregar Ubicación" button.

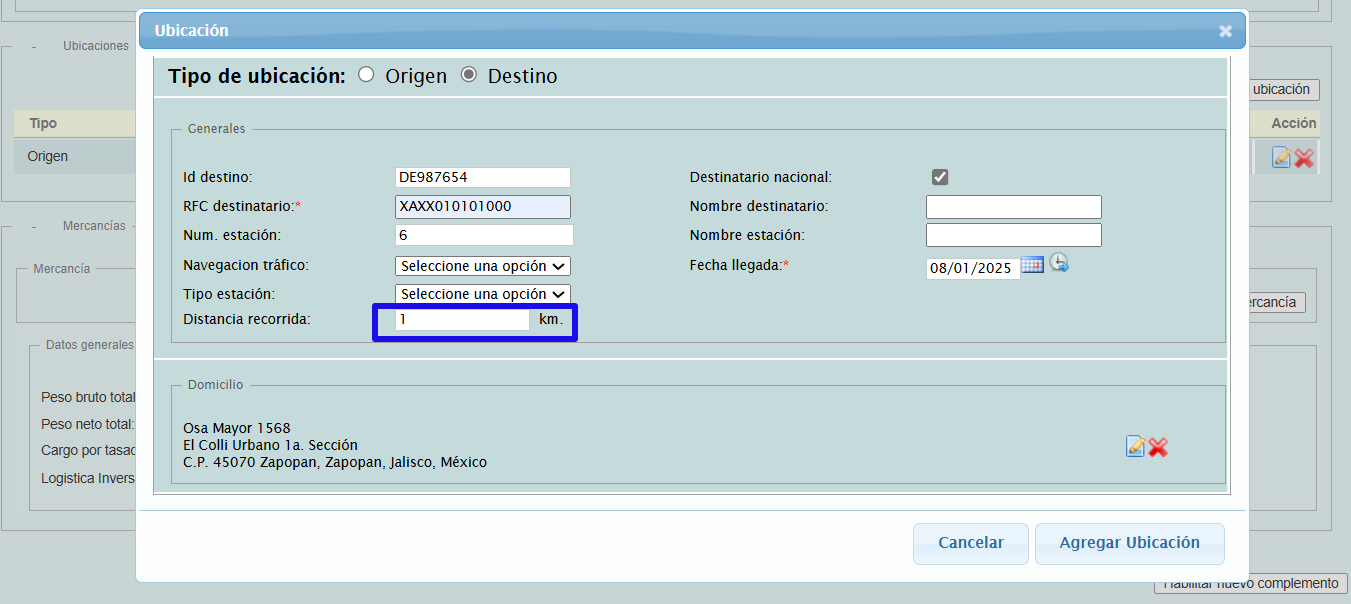

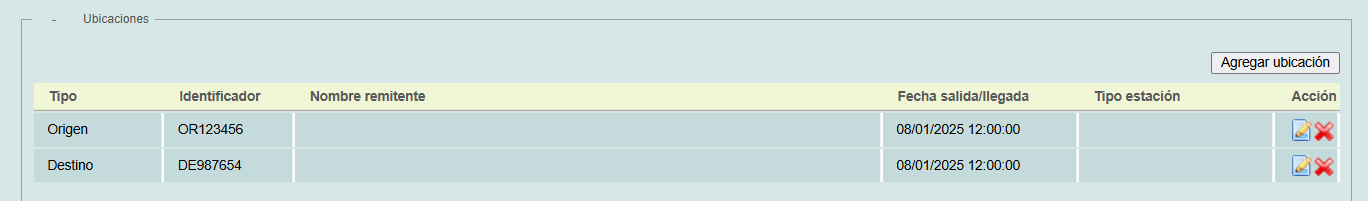

Go back to the "Ubicaciones" section and repeat these steps to add at least one destination location.

Note: For the destination location there is an additional mandatory field which is "Distancia recorrida".

The complement must have at least 2 registered locations, one source and one destination.

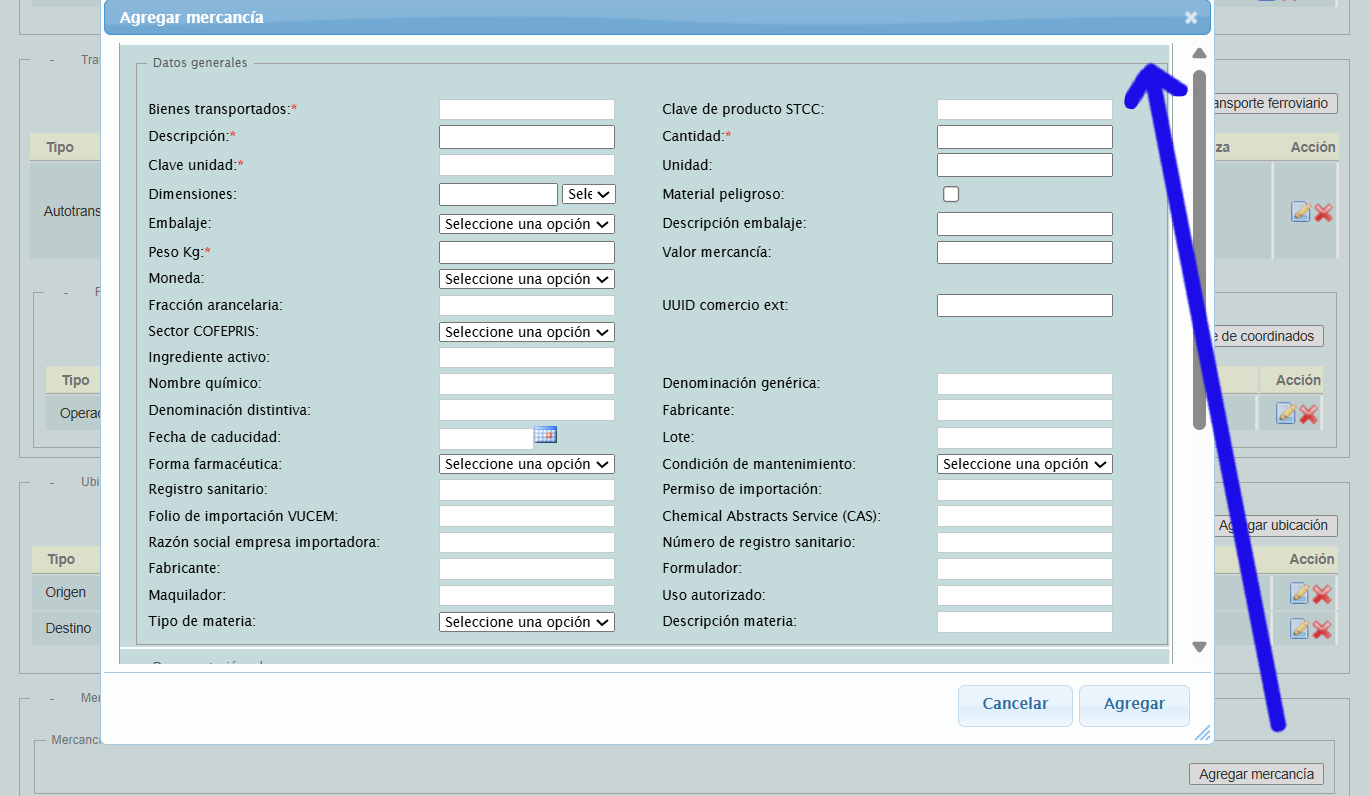

Finally, in the "Mercancías" section, add the items and fill in the general information.

Then, click the "Agregar mercancia" button.

Note: The "Guías" subsection can only be filled out if the goods transported are 31181701 or 24112700.

Note: The "Cantidad transportada" subsection is filled out if the identifiers (origen y destino) exist and there is more than one destination location.

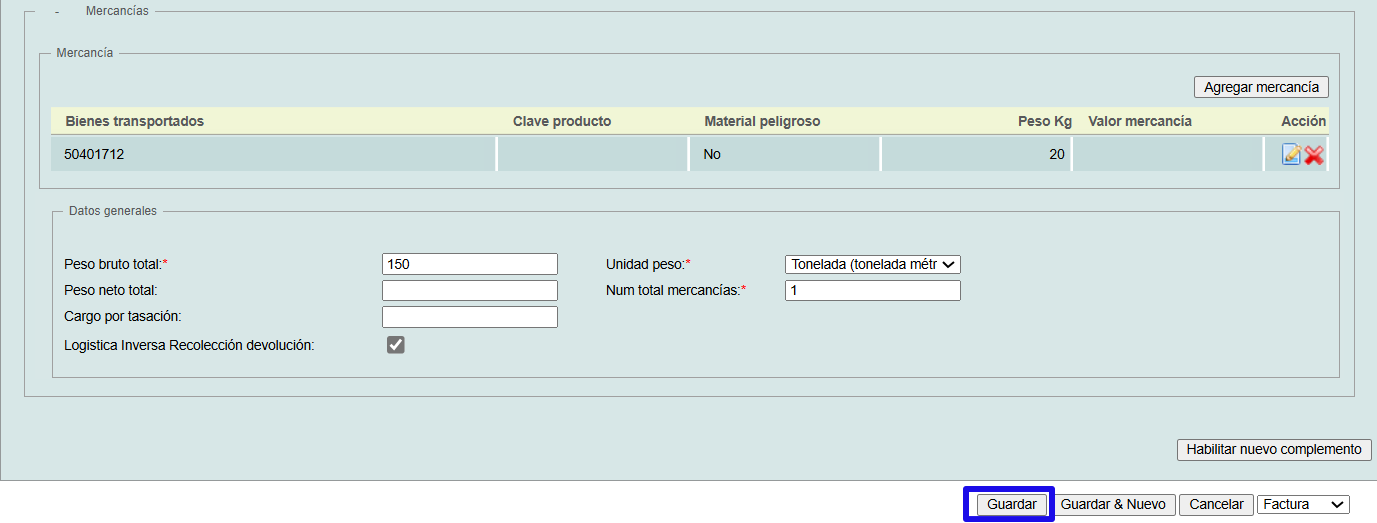

Finally, fill in the "Peso bruto total" fields, select the "Unidad peso" type, and enter the "Num total mercancías" If you require the "Logística inversa Recolección devolución" option, select the box.

After filling out all the necessary information and if the e-document is ready to be created, click the "Guardar" button. If you have any further questions, please don't hesitate to contact our support departament.