Tags: calculate, IVA, IEPS, tax, invoicing

Lesson ID-103.2.4

Updated to:

03/11/2025

Lesson objective

That the user knows:

- What is the tax base and how can it be modified?

- How to create an e-document with a 0% tax rate?

- How to create an e-document with tax exemption?

- How to create an e-document without tax?

Create an e-document with a specific tax base and tax type

What is the tax base and how can it be modified?

The taxable base is the amount to which the tax percentage is applied. This is generally the total amount of each product or service on an e-document. The system calculates this automatically or manually, depending on your preference.

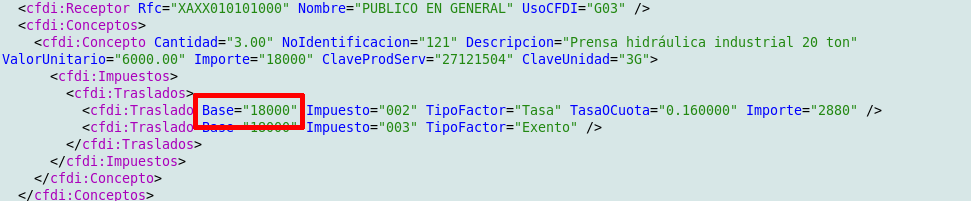

Automatic base calculation

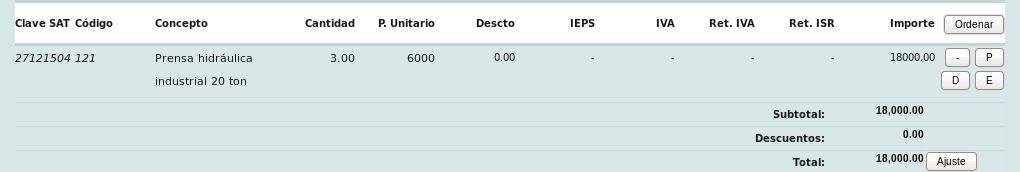

The default option is automatic calculation, which consists of multiplying the unit price by the quantity of each item.

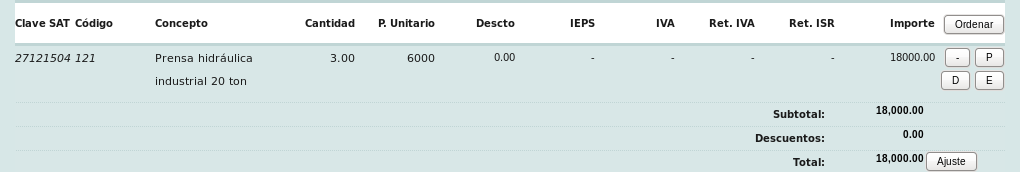

In this example, the system multiplies the prize 6000.00 by the quantity 3.00, giving a base of 18000. Applying the 16% tax to the base, we have: 0.16 x 18000.00, giving an IVA tax of 2880.00.

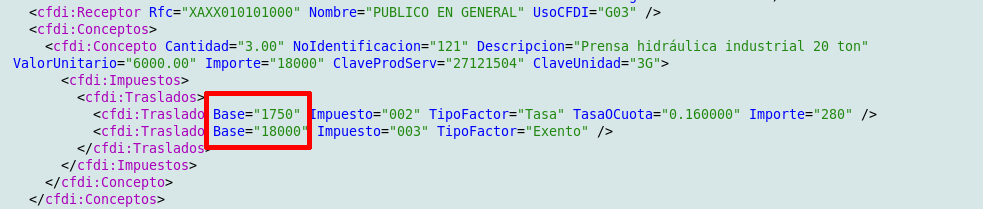

This can be verified by looking at the tax line for each item within the XML.

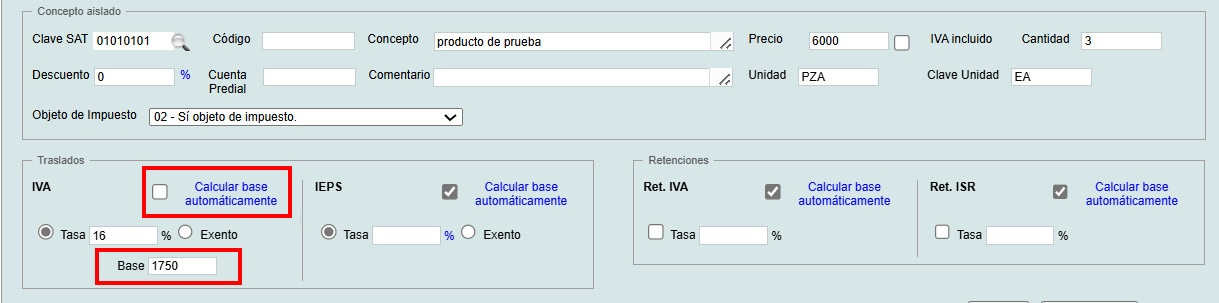

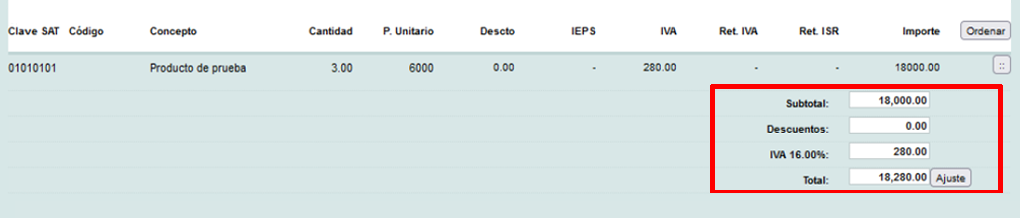

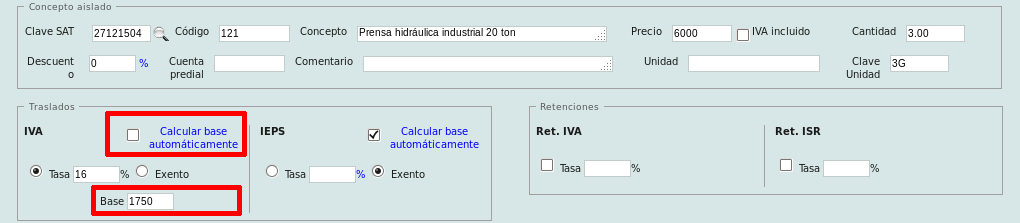

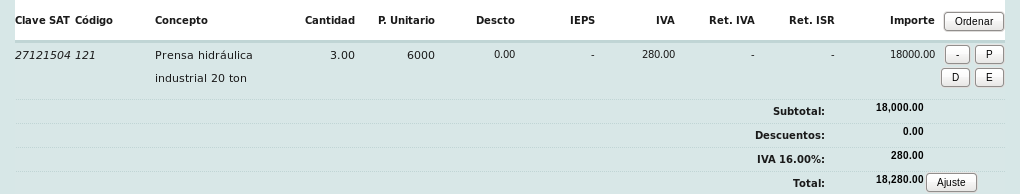

Manual base calculation

If you need to calculate a different base, you only need to deactivate the "Calcular base automáticamente" option next to each tax and specify the new base, which can contain up to 6 decimal places according to the SAT's filling guide.

In this example, the system uses 1750 as the base. Applying the 16% tax to the base, we have: 0.16 x 1750.00, resulting in a IVA tax of 280.00.

This can be verified by viewing the manually calculated tax line for each item within the XML file. Although the IEPS tax is exempt for this invoice, it is automatically calculated by the system because this option was enabled.

The calculation of the IEPS for transfer can be applied in 4 different ways, which you can see in lesson ID-103.2.5.

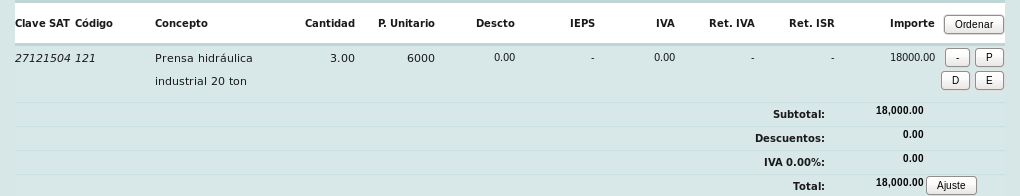

Invoice with 0% tax rate

When adding products or services, you can specify a IVA rate of 0% or 16%. When 0% is used, the system will still calculate the IVA even if the amount is $0.00. This will be specified on the invoice.

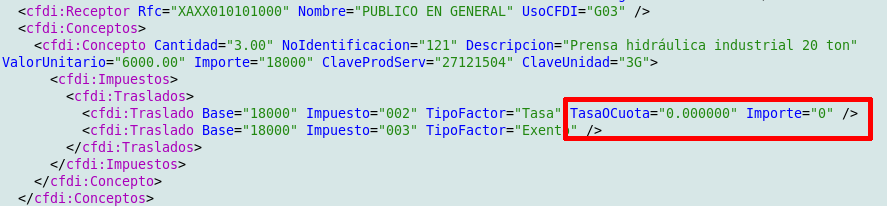

In this example the system applies the tax of 0%: 0.0 X 18000.00 giving the IVA tax of 0.00, which is added to the final amount.

This can be verified by viewing the tax line for each item within the XML file. You will see that the tax is indeed present.

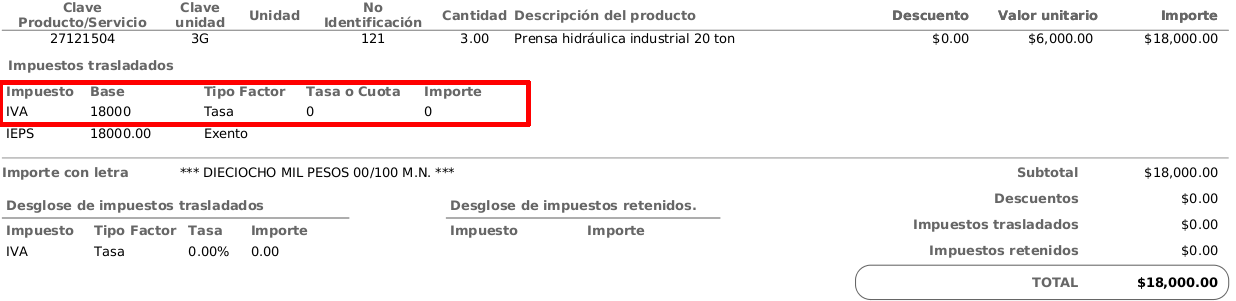

Similarly, the tax will be displayed when viewing the e-document.

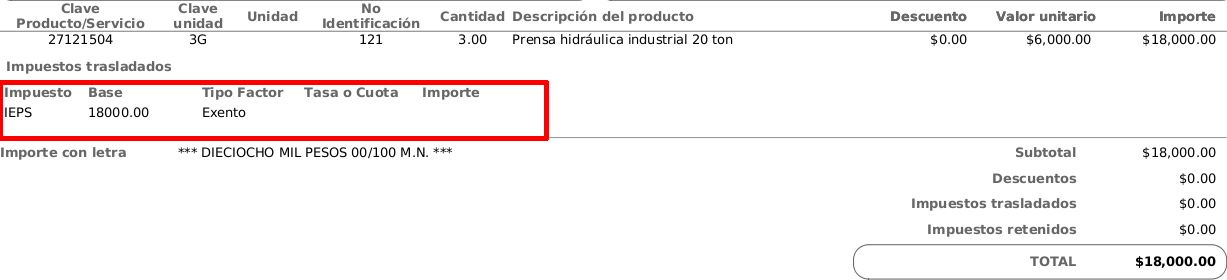

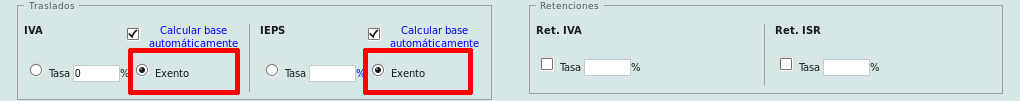

Invoice with tax exemption

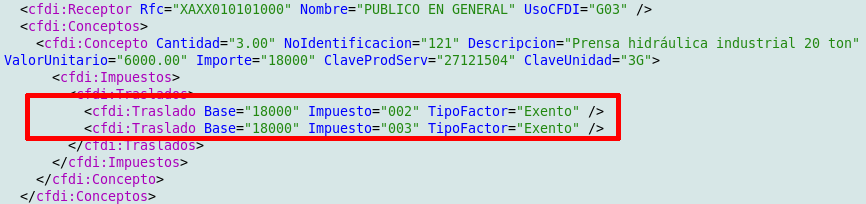

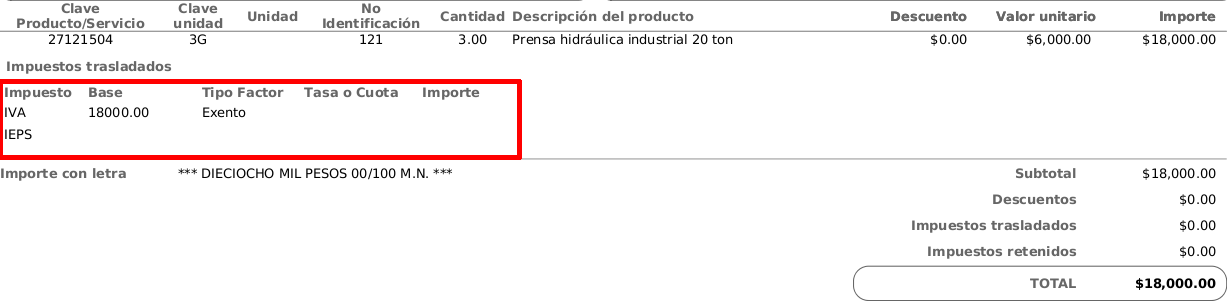

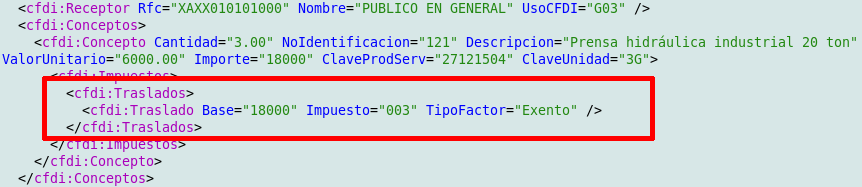

When adding products or services, you can specify that a tax will be exempt. This means the system will not calculate any tax on the product or service in question. The invoice will simply show that the amount is exempt for informational purposes.

Therefore, no tax amount will be shown. In this example, IVA and IEPS are exempt, so they are not included.

This can be verified by viewing the tax line for each item within the XML file. Both amounts are marked as exempt in the XML file, and this is for informational purposes only.

Similarly, the tax is shown as exempt on the e-document.

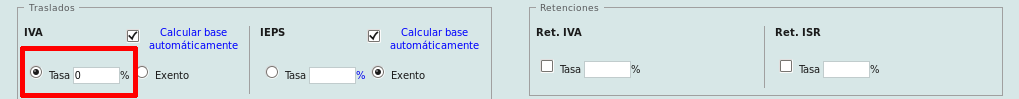

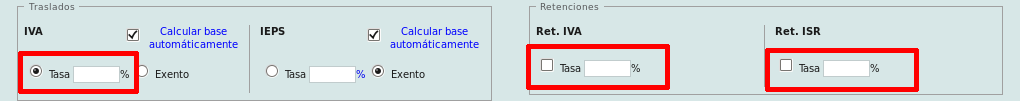

E-document without tax

When adding products or services, you can specify that a tax will not be applied. This means the system will not use the tax because no value is being assigned to it. It will not be included in the XML file and will not appear on the e-document, unlike a 0% tax rate or an exempt tax, which are shown in both the XML file and the e-document.

Therefore, no tax amount will be shown. In this example, IVA, IVA Withholding, and Income Tax Withholding have no value and are not taken into account. Only the Special Tax on Production and Services (IEPS) remains as exempt.

This can be verified by viewing the tax line for each item within the XML file. Since no value was specified for the taxes, they do not appear in the XML. Only the IEPS (Special Tax on Production and Services) is shown as exempt.

Similarly, none of the taxes without a specified value appear on the invoice. Only the IEPS (Special Tax on Production and Services) is shown as exempt.