Tags: configuration, new, regimen, company

Lesson ID-106.3.2

Updated to:

12/01/2026

Lesson objective

The user should know how to add a tax regime to their company in the system.

Tax regime

Your company's tax regime was recorded when you registered with the Solución Factible® electronic invoicing system; however, some companies add new tax regimes to their obligations.

Log in to the system as instructed in lesson ID-101.1

Once inside the portal, access the "Invoicing" module.

Next, click on the "Settings" button located in the "Actions" menu.

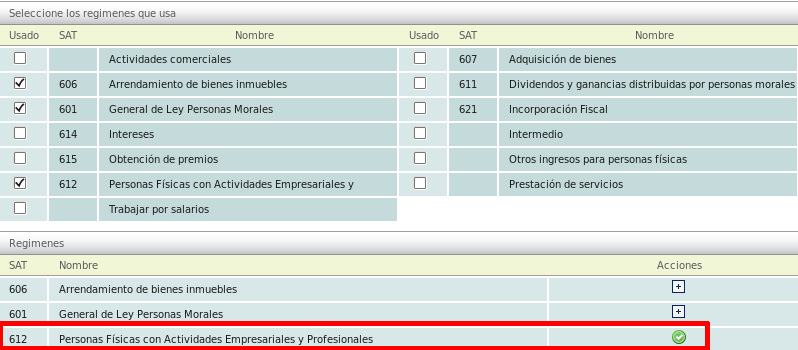

The available options in the settings panel will be displayed shortly. Click on the "Regímenes" option.

Regimes

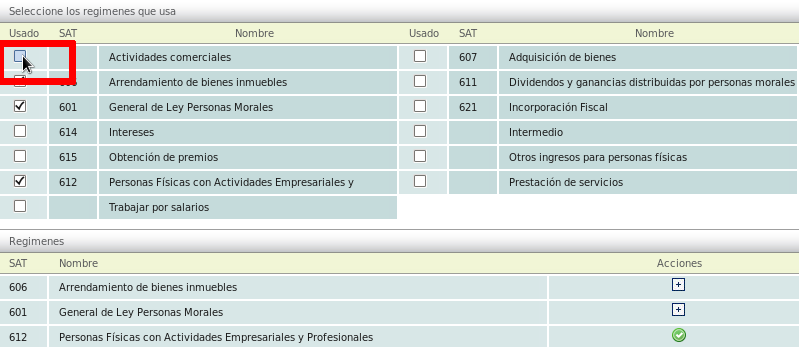

Upon logging in, you will be able to see the list of available tax regimes, and you will also be able to view your company's tax regime.

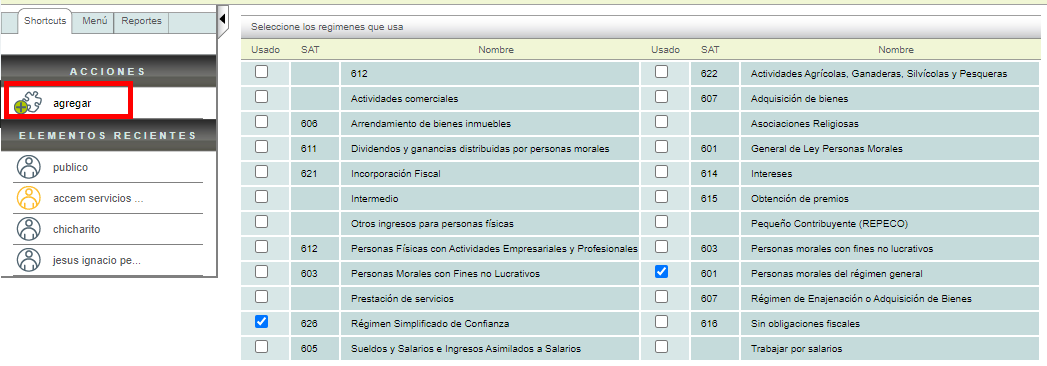

Add a new regime

Click on the "agregar" action.

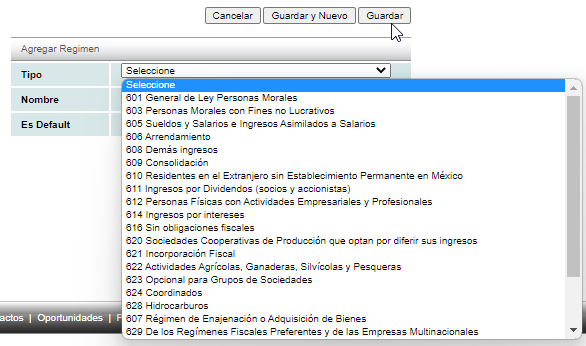

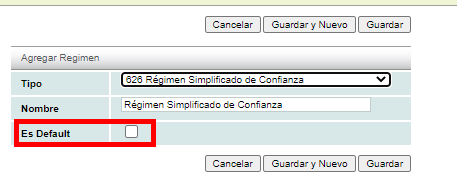

In the new form, indicate the code and name of the regime.

If you want this new setting to be selected by default, check the "Es Default" box. Then click the "Guardar" button.

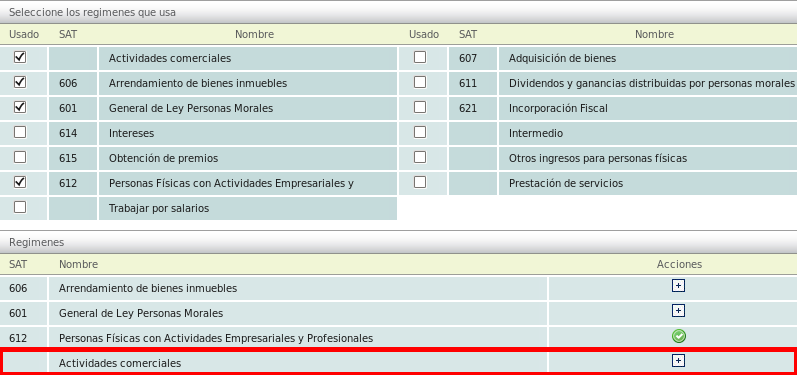

To include an additional plan, activate the checkbox located on the left side by clicking on the new plan for your company.

You will notice that the new scheme will be included in the list of assigned schemes.

If the tax regime under which you operate is not listed, please contact the Support team at Solución Factible®.