Tags: Invoicing, e-document

Lesson ID-103.18

Updated to: 20/11/2025

Lesson objective

That the user knows how to see if a postal code and product/service code applies for the 8% IVA border tax incentive.

IVA Check if a postal code or product/service code qualifies for the 8% IVA border tax incentive

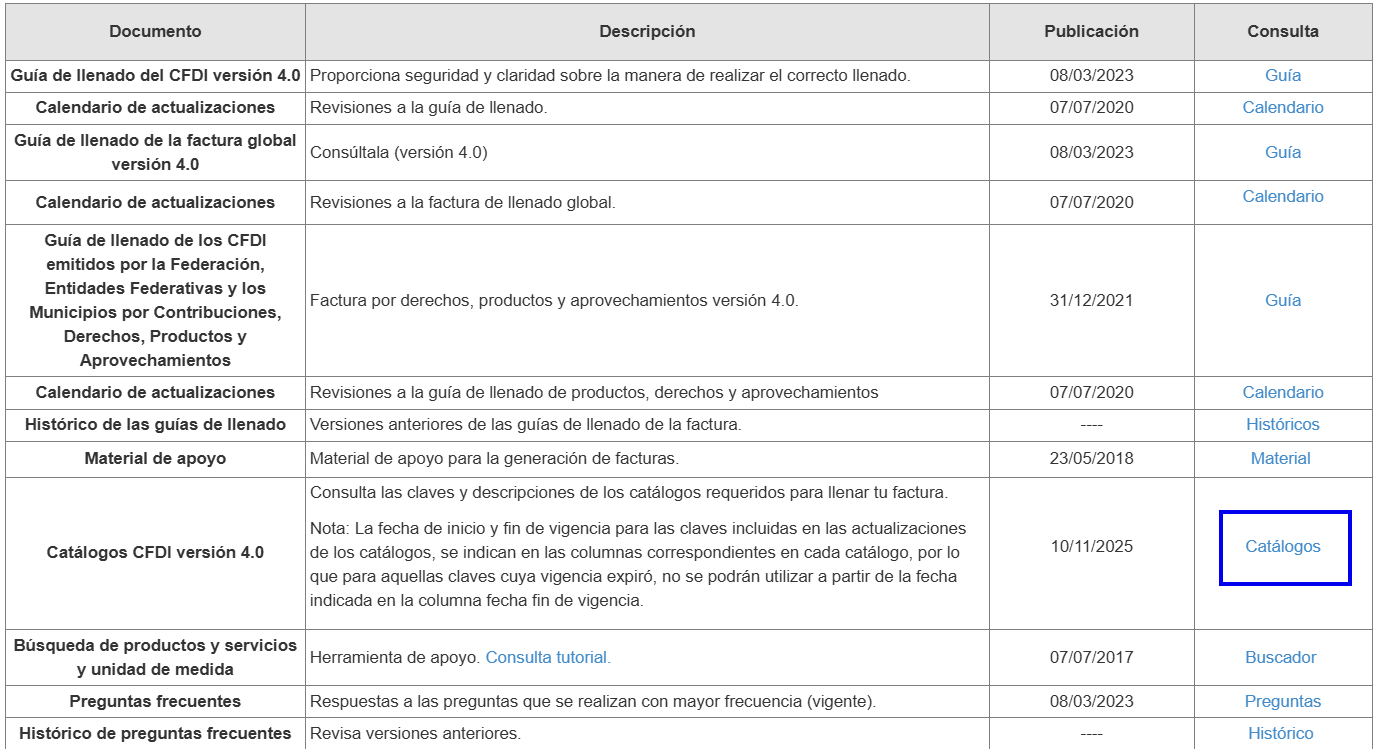

Go to the SAT´s Annex 20. In the document table, under the text "Here you will find the information necessary to issue it in version 4.0 of Annex 20", download the "Catálogos" by clicking on the 4th column (Excel file).

Open the file.

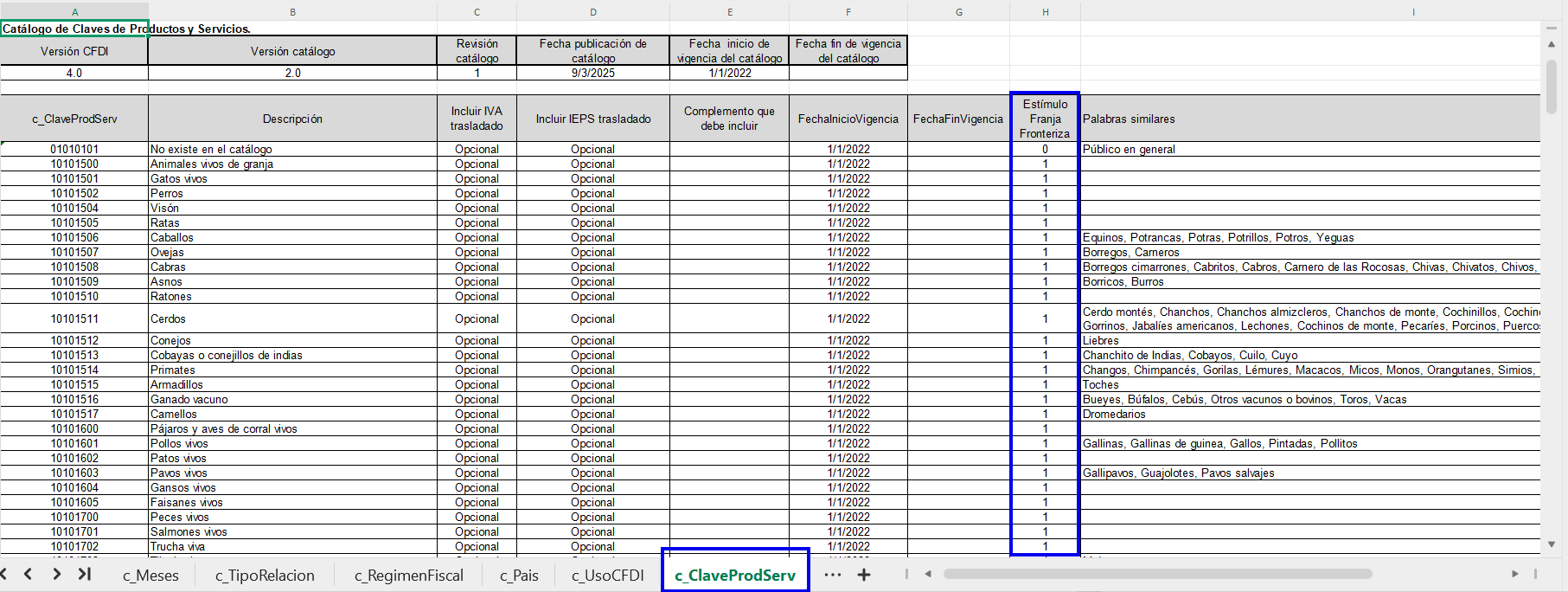

Product/service keys

Go to the c_ClaveProdServ sheet. The 8th column, called "Estímulo Franja Fronteriza" will display a 1 if the product/service DOES qualify for the tax incentive. It will display a 0 if the product/service DOES NOT qualify for the tax incentive.

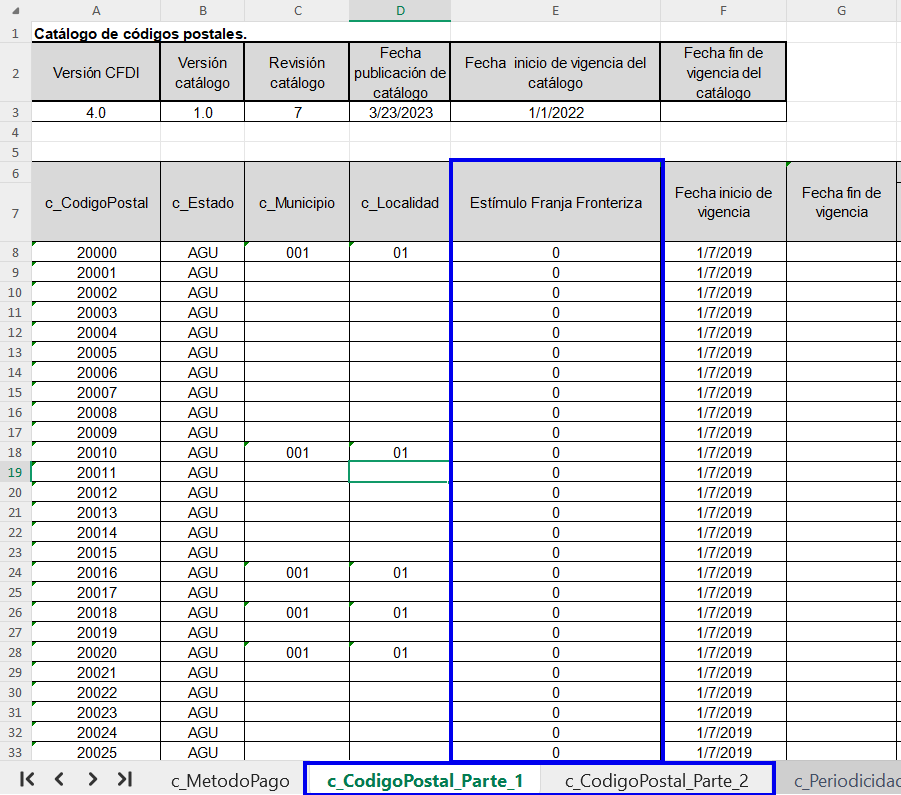

Postal codes/Códigos postales

There are 2 postal code sheets to cover all postal codes in the country: c_CodigoPostal_Parte_1and c_CodigoPostal_Parte_2.

The 5th column, labeled "Estímulo Franja Fronteriza" will display a 1 if the postal code DOES qualify for the tax incentive. It will display a 0 if the postal code DOES NOT qualify for the tax incentive.