CFDI 3.3 Cancel

Introduction

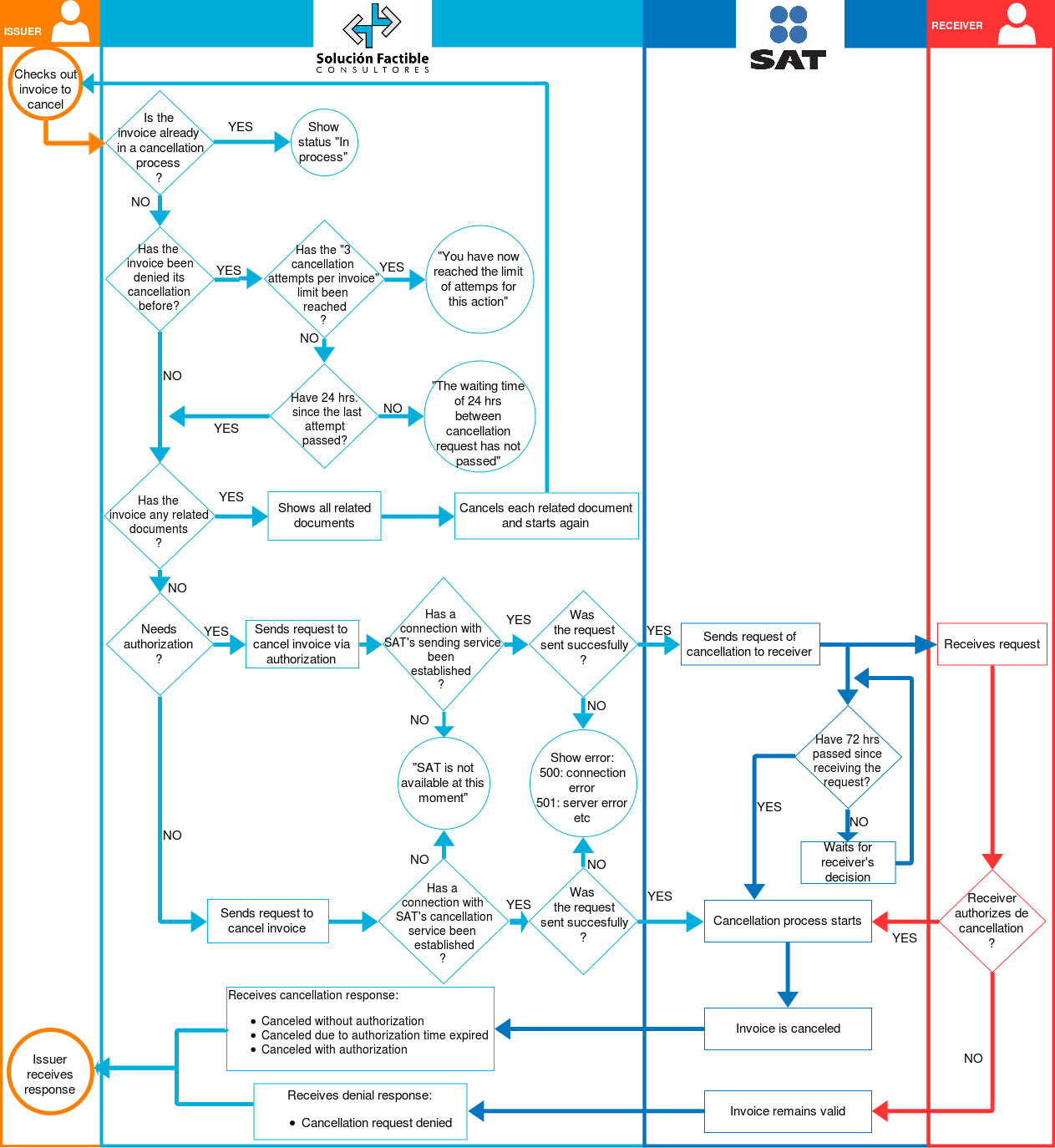

The cancellation process for issued invoices via the recipient's authorization, which will come

into effect in September 1st 2018, will be the new way of canceling invoices.

The new method will protect the receiver from undue, one-sided cancellations of invoices which have fiscal

value and were even paid. This being possible thanks to the receiver's new ability of accepting or denying

a cancel request.

Thus achieving more secured transactions between the tax payers, and avoiding fraud by canceling invoices

improperly.

Cancel process

As of today, to cancel an invoice, it is only needed to request it and it is automatically canceled. The

new process will require the authorization of the invoice's receiver before its cancellation can proceed.

Therefore an invoice may not be canceled if the receiver does not authorized it.

However there will remain several cases where an authorization wont be needed; such cases are explained

later in this document.

Additionally, several new cancellation statuses will be introduced, which the SAT will use to inform the current

cancel state of an invoice. It is important to remember that this new statuses are different to the invoice

status, which can only be "Vigente" (Valid) and "Cancelado" (Canceled).

Before a cancellation request can be made, some requirements must be fulfilled, they being:

1.- Does the invoice has had cancellation attempts before?

If you request a cancellation, but the receiver denies it, you still can make another request later, however only 3 cancellation requests per invoice are permitted, any further attempts will be denied automatically.

2.- Has the waiting time since the last denied cancellation attempt completed?

If an attempt to cancel an invoice was denied, you need to wait 24 hours to do so again.

3.- Does the invoice has related documents?

If the invoice you want to cancel has at least one related document, then it cannot be canceled and it

will have a cancellation status of "No Cancelable" (cannot cancel).

You will need to sever the connection to each related document. This is accomplished just by canceling

the related document. As a consequence, each related document must go through its own cancellation process.

When the invoice does not have any related documents, it is then needed to verify if the invoice requires authorization from the receiver, before making the request.

4.- Does the invoice requires authorization from the receiver?

There are certain criteria which define if an invoice requires authorization for its cancellation. If the invoice falls in any of the following cases, then it can be canceled without authorization from the receiver.

- Invoices declaring incomes up to 5,000.00$ MXN (taxes and withholdings included).

- Payroll invoices, including a payroll receive or fees receive.

- Invoices declaring expenditures, such as a credit note.

- Invoices declaring merchandise transportation, such as "carta porte".

- Invoices, declaring incomes, issued to any tax payer of the RIF (Régimen de incorporación fiscal).

- Invoices created using the SAT's tool "Factura facil".

- Invoices serving as withholdings.

- Invoices issued to the general public using the RFC: XAXX010101000.

- Invoices issued to someone living abroad Mexico, using the RFC: XEXX010101000.

- When the cancellation request is attempted before 72 hours since the invoice's issuing have passed.

- Invoices issued by a natural person of Mexico's primary sector.

- Invoices issued by someone who is part of Mexico's financial sector.

In this cases the invoice will have a cancellation status of "Cancelable sin aceptación" (does not require authorization to cancel), and the cancellation will come into effect immediately after the request is processed by the SAT. Once the request is sent, the invoice will have a cancellation status of "En proceso" (In process).

If the invoice does not fall in any of the above cases it will have a cancellation status of "Cancelable con aceptación" (Requires authorization to cancel), meaning it will need the receiver's authorization.

5.- Receiver's authorization

In case of needing authorization, Solución Factible will send the request to the SAT, who will forward

the request to the receiver. The request will have the issuer's RFC and name, along with the

invoice's id number.

Once the request is sent to the receiver, the invoice will have a cancellation

status of "En proceso" (In process).

The moment the receiver receives the cancel request, he or she will have 72 hours to authorize or deny it. If after 72 hours the receiver has given no answer, the invoice will be automatically canceled. And the issuer will be notified via Solución Factible.

6.- Cancellation response

Once the process is finished, the issuer will receive the response which will include the new invoice status along with the cancellation status.

- When the invoice was canceled without needing authorization, it will have the new Invoice status of "Cancelado" (Canceled) and the cancellation status of "Cancelado sin aceptación" (Canceled without authorization).

- When the invoice needed authorization and the request was granted, it will have the new Invoice status of "Cancelado" (Canceled) and the cancellation status of "Cancelado con aceptación" (Canceled with authorization).

- When the invoice needed authorization but the receiver did not give an answer and the 72 hours window timed out. It will have the new Invoice status of "Cancelado" (Canceled) and the cancellation status of "Cancelado plazo vencido" (Canceled due to authorization time expiration).

- When the invoice needed authorization and the request was denied, its Invoice status of "Vigente" (Valid) will remain the same and it will have a cancellation status of "Solicitud rechazada" (Cancellation request denied).

Process' flow chart